Business Flows

Outbound payment

The ClearBank Lenders connector allows you to initiate outbound transactions using an external deposit account for Mambu clients and Pure or Solidarity groups that have loan accounts using the Faster Payments Service (FPS) and the Clearing House Automated Payment System (CHAPS) schemes.

The ClearBank webhooks that can be triggered for the Outbound flow include:

TransactionSettledOutboundHeldTransactionPaymentMessageAssesmentFailedPaymentMessageValidationFailedTransactionRejected

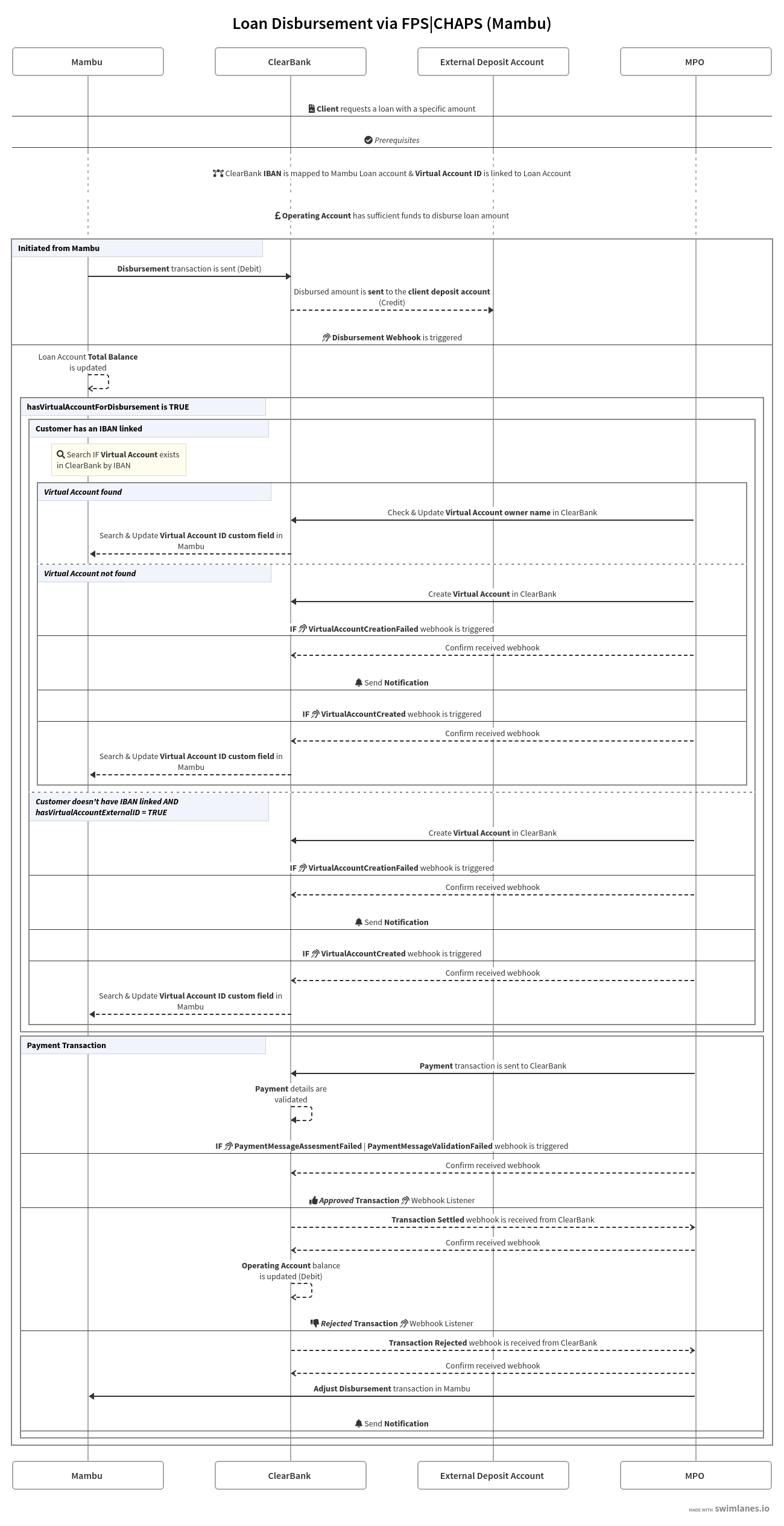

Mambu disbursement

This business flow applies to the following product configurations:

- Loans with multiple disbursements

- Revolving credit

- Tranched loans

- Interest-free loans

- Loans with a single disbursement

- Dynamic term loans

- Fixed term loans

- Products that are available for clients, groups, and solidarity groups.

When a disbursement transaction is initiated from Mambu using one of two transaction channels, MBU_Loan_Disbursement_FPS or MBU_Loan_Disbursement_CHAPS, a webhook is sent to Mambu Process Orchestrator (MPO) to trigger the process.

An approved loan account in Mambu is disbursed before the loan repayment cycle of the loan starts. Disbursement includes movement of the loan amount to the client account. For more information, see Loan Account Life Cycle and States. The funds used to disburse the loan are held in the operating account defined in ClearBank. Upon disbursement of the loan, the loan amount must move from the bank’s operating account to the client’s external deposit account. To reconcile this payment, the encoded key of the Mambu transaction is mapped to the ClearBank payment field transaction encoded key. This use case applies for new and existing ClearBank virtual accounts.

The Disbursement Scheme Router [link to Mambu webhook] process assesses whether the payment received from Mambu meets the following conditions:

- The loan account currency is in GBP.

- The maximum payment value for

FPSisGBP1m. - The transaction channel selected from the Mambu UI must match the one configured for the connector.

- The client in Mambu has at least one valid UK address populated, which should include: country; city or town, state, province, or municipality; street name; building number or building name; and postal code. For example: United Kingdom, London, Hackney, 55 Testing Road, AB1 2CD. This is required for the payment to be sent in ClearBank.

If any of these conditions are not met, the disbursement is adjusted in Mambu and a notification is sent via Mambu or a ZenDesk task. If the debtor address provided is greater than 140 characters for FPS or 105 characters for the CHAPS payment scheme, the debtor address is trimmed from the right-hand end until the length of debtor address is within the character limits. Country and city must always be visible.

The disbursement transaction must use a dedicated transaction channel based on the payment scheme, either MBU_Loan_Disbursement_FPS or MBU_Loan_Disbursement_CHAPS.

If the amount requested to be disbursed is greater than GBP1m and the payment scheme is FPS, the payment will be rejected by ClearBank. This is the maximum allowed amount for FPS. In this case, the disbursement transaction will be adjusted in Mambu.

For a revolving credit loan, the amount that should be disbursed needs to be specified in an editable field. For all other loan accounts, the amount is predefined and the amount field cannot be edited.

The data required for executing the Disbursement Scheme Router [link to Mambu webhook] process initiated from Mambu to ClearBank should be the following:

{

"debtorName": "Maria Velasquez",

"debtorIBAN": "GB72CLRB04062690545001",

"creditorIBAN": "GBR40478470872491",

"creditorName": "Mario Cruz",

"paymentReference": "loan disbursement"

}

| Parameter | Type | Description |

|---|---|---|

debtorName | string | The debtor’s name. |

debtorIBAN | string | The debtor’s ClearBank IBAN. |

creditorIBAN | string | The creditor’s external IBAN. |

creditorName | string | The creditor’s name. |

paymentReference | string | The payment reference for this transaction. |

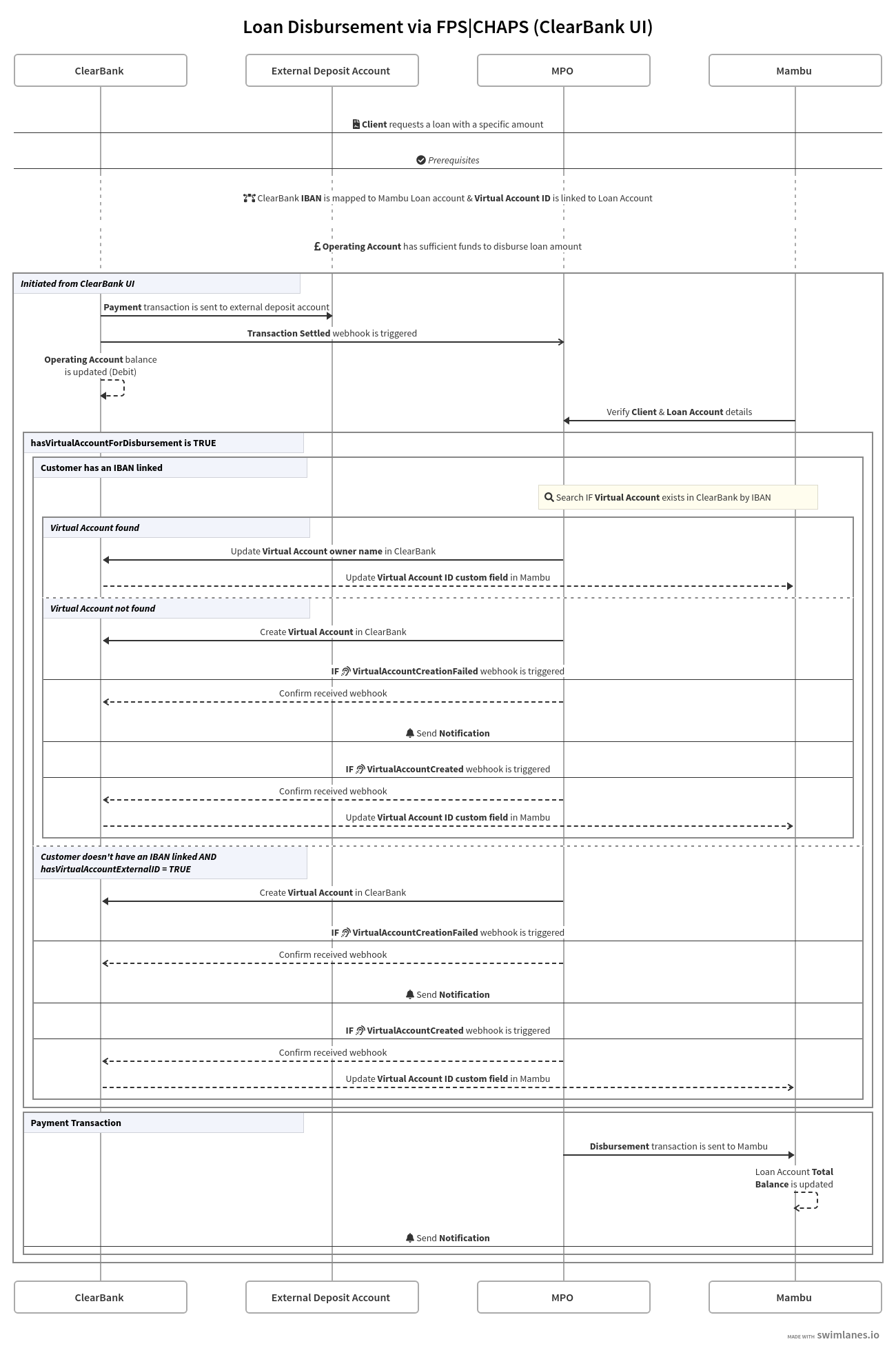

ClearBank disbursement

The process is automatically triggered when a payment is initiated and approved from within the ClearBank UI and a TransactionSettled webhook is sent to MPO.

An approved loan account in Mambu is disbursed before the loan repayment cycle of the loan starts. Disbursement includes movement of the loan amount to the client account. The funds used to disburse the loan are held in the operating account defined in ClearBank. Upon disbursement of the loan from the ClearBank UI, the loan amount must move from the bank’s operating account to the client’s deposit account. A payment initiated from the ClearBank UI is referenced back to Mambu using the loan ID to reconcile the payment. This use case applies for new and existing virtual accounts.

The UI_Disbursement Scheme Router [triggered by MPO webhook receiver] process assesses whether the payment made from ClearBank meets the following conditions:

- The payment scheme is

FPSorCHAPS. - The requested amount is within range.

- The disbursement transaction is made using dedicated transaction channels based on the payment scheme, either

CB_Loan_Disbursement_FPSorCB_Loan_Disbursement_CHAPS. If the Mambu disbursement transaction is not made using a dedicated transaction channel, the MPO process will not be triggered.

If any of the conditions are not met then a notification is sent via Mambu or a ZenDesk task. If the debtor address provided is greater than 140 characters for FPS or 105 characters for the CHAPS payment scheme, the debtor address is trimmed from the right-hand end until the length of debtor address is within the character limits. Country and city must always be visible.

In cases where the payment uses an internal IBAN, where only ClearBank accounts are involved, then the payment scheme will be Transfer instead of Payment.

In the ClearBank UI, the Reference field must contain the prefix UI- followed by the Mambu Loan Account ID. For example: UI-HDVC570. This enables you to differentiate transactions received and read from the ClearBank TransactionSettled webhooks versus those from the UI.

Please Note:

CHAPS payments that use numbers in the Reference field are automatically put into a Held state to be analyzed and released later if there are no issues with the payment. For more information, see the Outbound Held Payment flow section.

Multiple payments can be sent from the ClearBank UI using the Bulk Payment feature. This is equivalent to multiple disbursements in Mambu. When multiple payments are sent from the ClearBank UI, each payment transaction is logged separately in a different TransactionSettled webhook and the MPO process is triggered multiple times as each transaction is processed individually. Separate disbursement transactions are also executed and logged in Mambu.

Virtual accounts and disbursement

The following scenarios occur for different configurations of virtual accounts:

- When

hasVirtualAccountExternalIDistruein ClearBank: An IBAN is generated by ClearBank. The connector creates a unique external identifier and sends a request to ClearBank to generate the IBAN by mapping the unique external identifier toX-Request-ID. The IBAN generated is used to create the virtual account that is linked to the Mambu loan account. - When

hasVirtualAccountExternalIDisfalsein ClearBank: An IBAN must have been previously generated and linked to the Mambu loan account using a custom field. - When

hasVirtualAccountForDisbursementisfalsein ClearBank: After an outbound payment is initiated from the ClearBank UI, the disbursement transaction in Mambu is posted without verifying the association between the Mambu loan account and the ClearBank virtual account. - When

hasVirtualAccountForDisbursementistruein ClearBank: When an outbound payment is initiated from the ClearBank UI, the association between the Mambu loan account and ClearBank virtual account is verified and the disbursement transaction in Mambu is posted only after this validation step has completed successfully.

Disbursement with fees

The purpose of the Loan Fee Analyzer by Product Type process is to decide whether a loan account with fees is eligible to be disbursed from the ClearBank UI.

Loan amount predefined

Disbursements with fees initiated from ClearBank UI, apply when the loan amount that needs to be disbursed is predefined, which is the case for dynamic term loans, fixed term loans and interest free loans. In this case:

- Supported disbursement fees defined on the product level are

Flat, with or without the amount, and are a percentage of the loan amount. - Only fees which are active and marked as required are applied to the disbursement transaction.

- Any optional fees are ignored, regardless of whether the fee is flat or a percentage, with and without a pre-defined amount.

If a Payment Due fee is configured for the product and the disbursement transaction needs to be adjusted, this action needs to be done using the Mambu UI. In this case, a task will be created in either Mambu or ZenDesk, based on the notification channel configured during setup of the connector. The notification will include information on the transaction which needs to be analyzed and, if needed, the disbursement transaction can be undone from the Mambu UI and manually reposted using CB_Loan_Disbursement_FPS or CB_Loan_Disbursement_CHAPS as the transaction channel. For this case, a task is created with the following message:

> Task created due to: CANNOT_BULK_ADJUST_ACTIVATION_TRANSACTION | for Loan Account: XUYB628. Requested amount from ClearBank 900 GBP is different than disburse amount in Mambu 897.0 GBP. Task was created from MPO for payment scheme: FPS. Process ID: 721474. Payment in ClearBank was done with End to End ID: 01D0159C3EY44C831101545 and transaction Identifier Field Ref: 01D5154C8ED64C43 1020200512826404787. Disbursement in Mambu was not Adjusted.

Custom loan amount

When the loan amount that needs to be disbursed is custom, which is the case for revolving credit loan accounts, these principles apply:

- Only flat disbursement fees with predefined amounts supported on the product level are supported.

- Only active fees which are marked as required will be applied to the disbursement transaction

- Any optional fees are ignored regardless of whether the fee is flat or percentage and with or without a pre-defined amount.

If a revolving credit loan product has Active flat disbursement fees, without an amount or any other disbursement fee that is calculated based on a defined percentage of the loan amount, the disbursement transaction cannot be made in Mambu since the loan and fees amounts are custom and would need to be provided. In this case, a task is created in the configured notification system. The task contains the following message:

> Task created due to: ClearBank Disbursement cannot be done with custom amounts or On The Fly fees (undefined amounts, loan amount percentage): REVOLVING_CREDIT. Disbursement should be done from Mambu UI using dedicated transaction channel for Loan Account: UFRH170. Task was created from MPO for payment scheme: FasterPayments. Process ID: 721471. Payment in ClearBank was done with End to End ID: 01D5154C3ED64C831101545 and transaction Identifier Field Ref: 01D5154C8ED64C43 1020200512826404787. Disbursement in Mambu was not done.

Please Note:

For revolving credit accounts, if fees are defined on the product level and the loan is eligible for disbursement, all required fees will be applied only for the first disbursement. Starting with the second disbursement all required fees are seen as optional. Only if a specific optional fee needs to be applied for sequential payments, does the disbursement transaction need to be done from Mambu.

Loan amount predefined at tranche level

When the loan amount that needs to be disbursed is predefined at tranche level, which is the case for tranched loans, these principles apply:

- Defined disbursement fees on the product level supported are

Flat(with amount) and the loan amount ispercentage. - Only active fees marked as required will be applied to the disbursement transaction.

- Any optional fees are ignored regardless of whether the fee is flat or percentage and with or without a predefined amount.

If a Tranched Loan loan product has Active flat disbursement fees without a pre-defined amount, the disbursement transaction will not be done in Mambu as an amount needs to be provided for the fees. In this case, a task will be created in the notification system configured for the connector and the transaction should be saved in order to be analyzed. The task will contain the following message:

> Task created due to: ClearBank Disbursement cannot be done with Undefined Disbursement Fee amount (product configuration): TRANCHED_LOAN. Disbursement should be done from Mambu UI using dedicated transaction channel for Loan Account: JVOG078. Task was created from MPO for payment scheme: FasterPayments.

Process ID: 721471. Payment in ClearBank was done with End to End ID: 01D5154C8ED64C431101745 and transaction Identifier Field Ref: 01D5154C8ED64C43 1020200512826404787. Disbursement in Mambu was not done.

Please Note:

For tranched loans, if fees are defined on the product level and the loan is eligible for disbursement, all required fees will be applied only for the first tranche. Starting with the second tranche, all required fees are seen as optional. Only if a specific optional fee needs to be applied for sequential tranches does the disbursement transaction need to be done from Mambu.

Negative flows

For negative flows, if notifications is set to true, then a task will be created in the configured notification system with a specific error message. The status and identifiers of the payment to be analyzed will be included in the task. Usually when a task is created, an analysis of the payment should be carried out, which can require manual intervention. For example, re-posting the disbursement in Mambu with the correct values.

> Task created due to: Requested amount from ClearBank 60000 GBP is different than Mambu disbursed amount 50000 GBP. for Loan Account: JHSJ079.

Task was created from MPO for payment scheme: FasterPayments. Process ID: 684129. Payment in ClearBank was done with End to End ID: 4a4de888022d4f5b84d8e1e864dc4b90 and transaction Identifier Field Ref: d0f646497e994cdeba1020200323826040626. Disbursement in Mambu was not done.

Please Note:

When the disbursement transaction needs to be manually posted in Mambu using the same payment data as in ClearBank one of the following transaction channels must be used depending on the payment scheme: CB_Loan_Disbursement_FPS or CB_Loan_Disbursement_CHAPS. This is because the payment is already registered in ClearBank.

The data required for executing the main connector process for payments initiated from ClearBank to Mambu, where Account Number and Sort Code are external is:

{

"Account Holder Name": "Mario Cruz",

"Account Number":"70872491",

"Sort Code":"404784",

"Amount": 15000,

"Reference": "UI-HDVC570"

}

| Parameter | Type | Description |

|---|---|---|

Account Holder Name | string | The account holder’s name. |

Account Number | string | The external account number. |

Sort Code | string | The external sort code to use. |

Amount | number | The payment amount. |

Reference | string | The Mambu loan account ID. |

Outbound held payment

Following an outbound held payment, two webhooks will be received. One for each of the following stages:

Initial notification:

OutboundHeldTransaction

Then, following investigation:

False Positive: The payment is released - TransactionSettled.True Positive: The payment remains under investigation.

The ClearBank webhook OutboundHeldTransaction is only triggered when the payment should be monitored or investigated, for example during sanctions screening. The OutboundHeldTransaction webhooks are stored in the Payment Webhook state diagram. A notification is sent as either a Mambu task or to ZenDesk notification with the following message:

> Task created due to:Outbound payment transaction is Held in ClearBank for Loan Account: WEUB834. Task was created from MPO for payment scheme: CHAPS.

Process ID: 684116. Payment in ClearBank was not made with End To End ID: 8a013bca70e46d540170edc0d7b00bc5. Disbursement in Mambu was Adjusted.

If your analysis reveals that the result is a False Positive, the payment is automatically released, and if the payment is successful a, TransactionSettled webhook is sent using the EndtoEndTransactionID field to match the payment in ClearBank. The payment is stored under Clearing Transactions in the ClearBank UI until any manual analysis has been carried out.

If a held transaction is rejected in ClearBank, then a TransactionRejected webhook is sent, the withdrawal transaction is adjusted, and the value of the transactionStatus custom field is updated from Held to Rejected.

If the result is True Positive then the payment is re-routed to your defined suspense account until further instructions are received.

Please Note:

- When the disbursement is initiated from ClearBank after the payment has been released and the

TransactionSettledwebhook sent, the disbursement transaction will be automatically posted to Mambu. - When the disbursement is initiated from Mambu after the payment has been released and

TransactionSettledwebhook sent, the disbursement transaction must be manually posted in Mambu using the same payment details as in ClearBank and either theCB_Loan_Disbursement_FPSorCB_Loan_Disbursement_CHAPStransaction channels should be used, since the payment is already registered in ClearBank.

Outbound reversal FPS

Outbound Reversal applies only for the Faster Payments scheme. Following a FasterPayments reversal three TransactionSettled webhooks will be received. One for each of the following stages:

- First Debit:

isReturn:false - First Credit (reversal):

isReturn:true - Second Debit (retry):

isReturn:false

After an outbound payment the TransactionSettled webhook is sent for debit transaction with isReturn:false is acknowledged, if the FasterPayments scheme does not respond within 30 seconds, the transaction will be automatically reversed or returned by ClearBank. During the Reversal process a new TransactionSettled webhook is sent by ClearBank for the credit containing isReturn:true and the disbursement transaction is adjusted in Mambu.

A notification is sent when TransactionSettled webhook with isReturn:true is received with the following content:

> Task created due to: Payload needs to be investigated TransactionSettled webhook received, for transaction with End To End ID: d244d267be9d47e18a77ada47f963d5e and transaction Identifier Field Ref: 2a6de672601f4124af1020200319826040626. Payment was made in ClearBank and was not processed in Mambu. Task was created from MPO for payment scheme: FasterPayments. Process ID: 684152.

ClearBank will try to resend the transaction (retry) and a new TransactionSettled webhook for the debit transaction is sent with isReturn:false. All three webhooks or transactions from the Reversal process are matched in ClearBank using the EndtoEndTransactionID.

Please Note:

- The third

TransactionSettled(theSecond Debit - isReturn:false) webhook may be a Single Immediate Payment with the suffix of10, in which case it will be sent almost immediately, or a Forward Dated Payment with a suffix of40, in which case it can be sent hours or days later. - When the disbursement is initiated from ClearBank after the second debit transaction is sent the disbursement transaction will be automatically posted to Mambu.

- When the disbursement is initiated from Mambu after the second debit transaction is sent the disbursement transaction must be manually posted in Mambu using the same payment details as in ClearBank and using the transaction channel

CB_Loan_Disbursement_FPS.

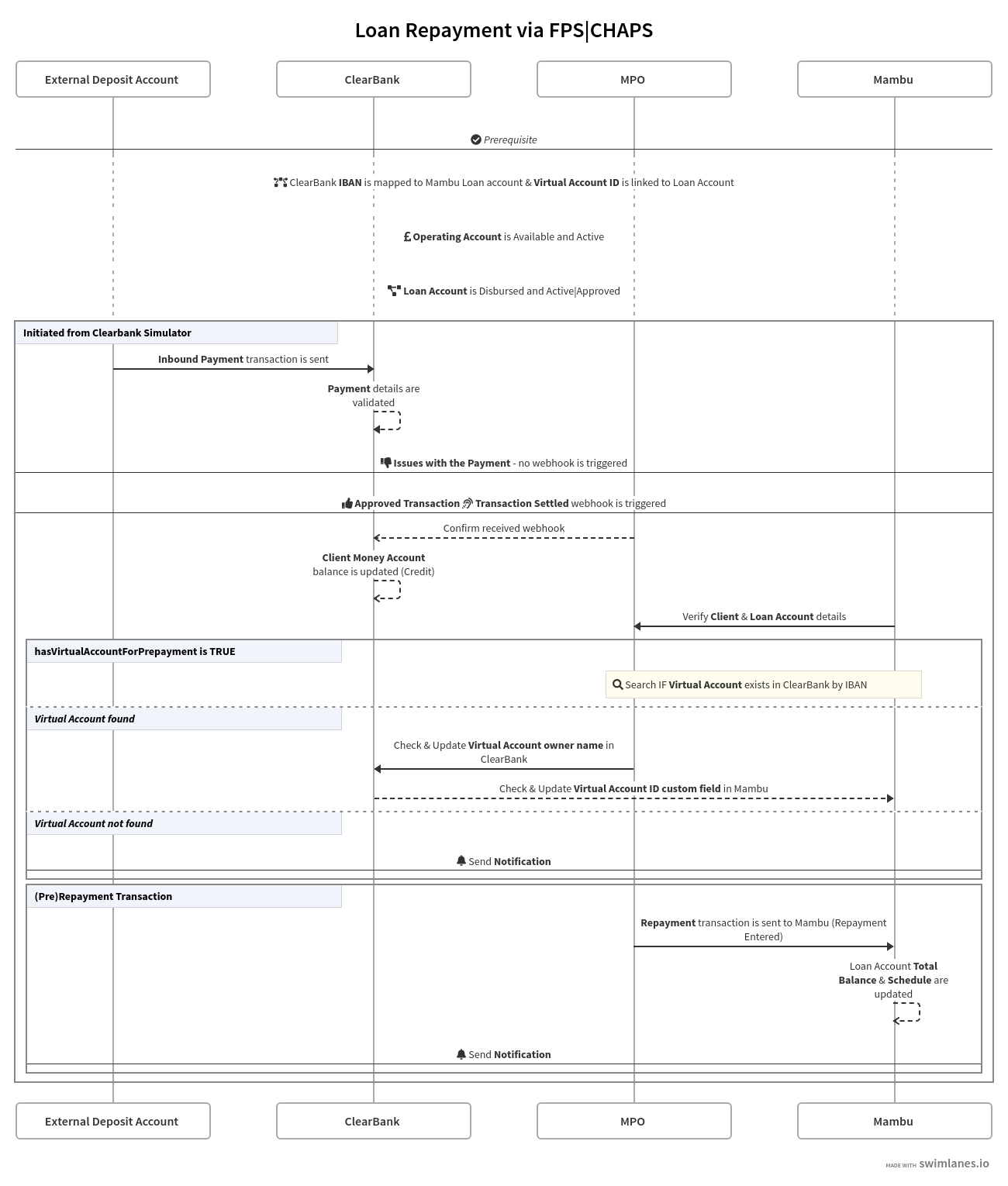

Inbound payment

This flow allows you to initiate inbound transactions using an external deposit account for Mambu clients and pure or solidarity groups that have Mambu loan accounts using the Faster Payments Service (FPS) and the Clearing House Automated Payment System (CHAPS) schemes.

This business flow is compatible with the following product configurations:

- Loans with multiple disbursements

- Revolving credit

- Tranched loans

- Loans with single disbursements

- Dynamic Term loans

- Fixed Term loans

- Interest-free loans

- Products that available for clients, groups, and solidarity groups.

The ClearBank webhooks that can be triggered for Inbound flow include:

TransactionSettledInboundHeldTransaction

The LoanPrePayment Scheme Router [triggered by MPO webhook receiver] process is automatically triggered when a payment is initiated from the ClearBank Portal Simulator and a TransactionSettled webhook is received by MPO. The purpose of this process is to decide if the payment received from ClearBank needs to be routed via FPS or CHAPS. If any conditions are not met then a notification is sent.

Once the loan is successfully disbursed, the loan repayment cycle starts according to the schedule of the loan. The client may choose to repay the loan based on regular monthly payments or prepay any arbitrary amount. The incoming payment made via the FPS/CHAPS scheme is cleared and settled into the bank’s operating account in ClearBank. This incoming payment contains a reference to the Mambu Loan Account ID to reconcile payments between ClearBank and Mambu. When a successful TransactionSettled webhook is received from ClearBank, a loan prepayment must be acknowledged and new loan schedule generated in Mambu.

The repayment transaction must be made using a dedicated transaction channel based on the payment scheme; either CB_Loan_Repayment_FPS or CB_Loan_Repayment_CHAPS.

In the ClearBank Portal Simulator, the Payment Reference field can contain only the Loan Account ID from Mambu (for example, HDVC570) or the prefix UI- followed by the Loan Account ID from Mambu (for example, UI-HDVC570) to identify the loan account where the repayment will be posted in Mambu.

For negative flows, if notifications have been enabled during setup of the connector, a task will be created in either Mambu or ZenDesk with a specific error message and details of the transaction - including state and relevant identifiers. When a task is created, an analysis of that payment should be done, which may lead to manual intervention in Mambu or needing to contact ClearBank for follow-up information.

The data required for executing the Loan Repayment FPS process manually is:

{

"Payment Reference": "UI-HDVC570",

"Amount": 1000,

"Creditor Name": "Maria Velasquez",

"Creditor Sort Code":"040626",

"Creditor Account Number":"90545001",

"Debtor Name": "Mario Cruz",

"Debtor Sort Code":"404784",

"Debtor Account Number":"70872491"

}

| Parameter | Type | Description |

|---|---|---|

Payment Reference | string | The payment reference |

Amount | number | The payment amount. |

Creditor Name | string | The name of the creditor. |

Creditor Sort Code | string | The sort code of the creditor. |

Creditor Account Number | string | The account number to use for the creditor. |

Debtor Name | string | The name of the debtor. |

Debtor Sort Code | string | The sort code of the debtor. |

Debtor Account Number | string | The account number to use for the debtor. |

The data required for executing the Loan Repayment CHAPS process manually is:

{

"Payment Reference": "UI-HDVC570",

"Amount": 1000,

"Creditor IBAN": "GB72CLRB04062690545001",

"Debtor IBAN":"GB68HBUK40478470872491",

"Creditor BIC 11":"CLRBGB22011",

"Debtor BIC 11":"HBUKGB4BXXX"

}

| Parameter | Type | Description |

|---|---|---|

Payment Reference | string | The payment reference |

Amount | number | The payment amount. |

Creditor IBAN | string | The creditor’s IBAN number. |

Debtor IBAN | string | The debtor’s IBAN number. |

Creditor BIC 11 | string | The creditor’s 11 character BIC. |

Debtor BIC 11 | string | The creditor’s 11 character BIC. |

Please Note:

If the repayment needs to be manually posted in Mambu after the payment is released and TransactionSettled webhook is sent, the CB_Loan_Repayment_FPS transaction should be used since the payment is already registered in ClearBank.

Virtual accounts and inbound payments

The following scenarios occur for different configurations of virtual accounts:

- If

hasVirtualAccountForPrePaymentisfalsein ClearBank: After an inbound payment is initiated from the Payment Simulator the repayment transaction in Mambu is posted without verifying the association between Mambu and ClearBank using the virtual account ID and IBAN. - If

hasVirtualAccountForPrePaymentistruein ClearBank: When an inbound payment is initiated from the Payment Simulator, the association between Mambu and ClearBank via virtual account ID and IBAN logic verified and the repayment transaction in Mambu is posted only after this validation has been successfully completed.

Inbound held payment

Following an inbound held payment, two webhooks will be received. One for each of the following stages:

Initial stage flagging a held transaction:

InboundHeldTransaction

Follow up webhook after investigation:

False Positive: The payment is released - TransactionSettled.True Positive: The payment remains under investigation.

The ClearBank webhook InboundHeldTransaction is triggered only when the payment should be monitored or investigated. For example, to carry out sanction screenings, the InboundHeldTransaction webhook is stored in Payment Webhook state diagram. A notification is sent as a Mambu or ZenDesk task with the following message:

> Task created due to:Inbound payment transaction is Held in ClearBank for Loan Account: WEUB834. Task was created from MPO for payment scheme: CHAPS.

Process ID: 684116. Payment in ClearBank was not made with End To End ID: 8a013bca70e46d540170edc0d7b00bc5. Repayment in Mambu was Adjusted.

If the results are False Positive, then the payment is automatically released, a TransactionSettled webhook sent, and the repayment transaction is automatically posted in Mambu. In ClearBank, the transactions are matched using the EndtoEndTransactionID field.

If the result are True Positive, the payment will be re-routed to the designated suspense account until more instructions are received and no TransactionRejected webhook is received by ClearBank. An inbould held transaction is not available in ClearBank using the UI or API.

Please Note:

- If the repayment needs to be manually posted in Mambu after a

TransactionSettledwebhook is received, indicating the payment has been released, either theCB_Loan_Repayment_FPSorCB_Loan_Repayment_CHAPStransaction channel should be used as the payment is already registered in ClearBank. - An inbound held transaction is not shown in ClearBank UI under Clearing Transactions.

Inbound Reversal FPS

Inbound Reversal applies only for the FPS scheme. Following a FasterPayments reversal, three TransactionSettled webhooks will be received. One for each of the following stages:

- First Credit:

isReturn:false - First Debit (reversal):

isReturn:true - Second Credit (retry):

isReturn:false

After an inbound payment is sent and TransactionSettled (Credit - isReturn:false) webhook is acknowledged, if the FasterPayments scheme does not respond in less than 30 seconds, the transaction will be automatically reversed or returned by ClearBank. During the reversal process, a new TransactionSettled webhook is sent by ClearBank (with Debit - isReturn:true) and the repayment transaction in Mambu is adjusted.

ClearBank will try to resend the transaction, at which point a new TransactionSettled webhook (with Credit - isReturn:false) will be sent and the repayment transaction posted automatically to Mambu. All three webhooks or transactions from the reversal process are matched in ClearBank using the EndtoEndTransactionID value.

Please Note:

- If the repayment needs to be manually posted in Mambu after the payment is released and

TransactionSettledwebhook is sent, theCB_Loan_Repayment_FPStransaction channel must be used as the payment is already registered in ClearBank. - The third

TransactionSettledwebhook (or theSecond Credit - isReturn:false) might be a Single Immediate Payment with a suffix of10, in which case it will be sent almost immediately, or a Forward Dated Payment with a suffix of40, in which case it can be sent hours or days later.

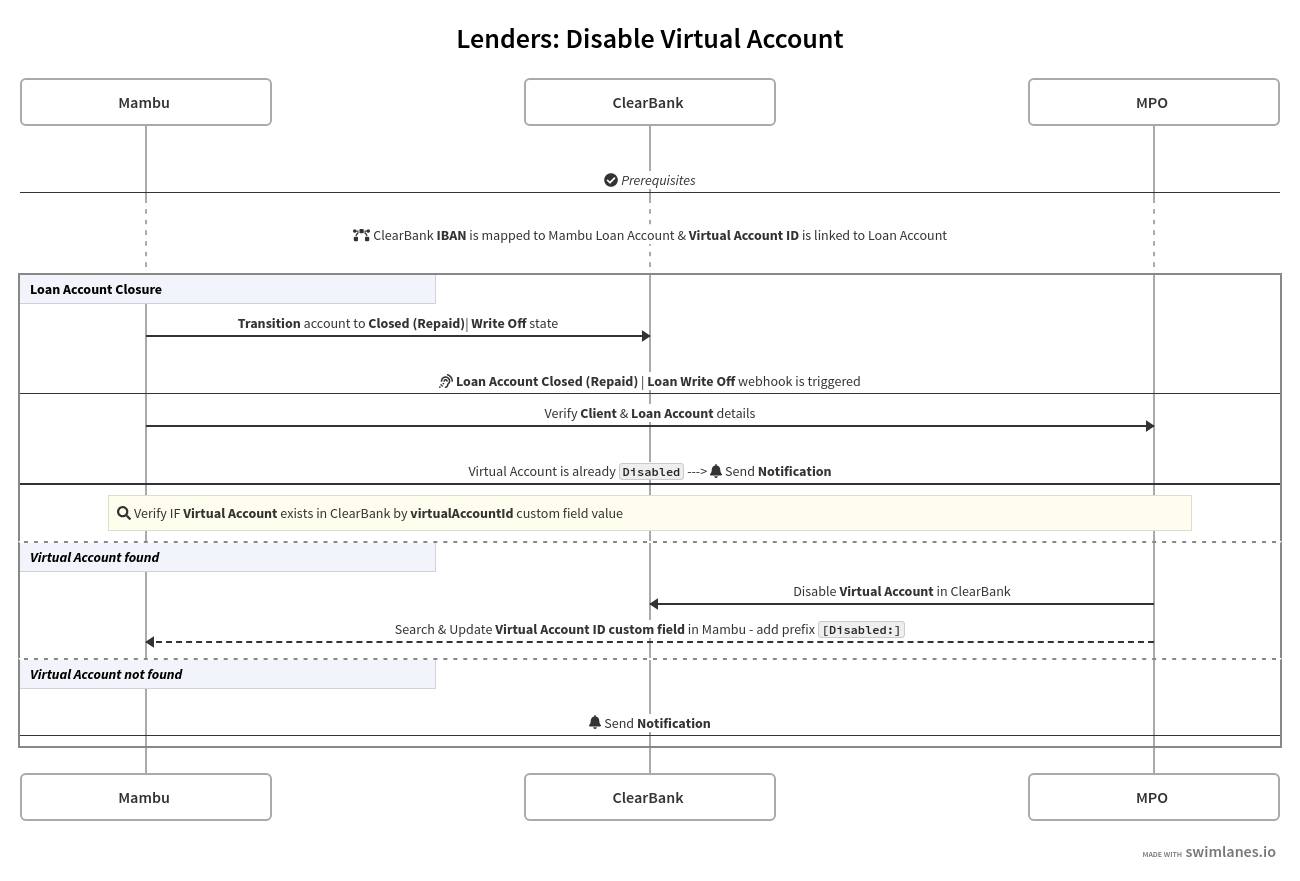

Disable virtual account

This template allows you to disable a virtual account from ClearBank when a Mambu loan account for a client or group is closed as either repaid or written off. Disabling a virtual account is an irreversible action and the virtual account cannot be re-activated. If the loan account is reopened for any reason, it should be mapped to a new IBAN.

The Disable virtual account [link to Mambu webhook] process is automatically triggered when the loan account is transitioned to the Closed (Repaid) or the Write Off state and the custom field virtualAccountId is not empty. Once a loan is transitioned to Closed (Repaid) or Write Off state, the virtual account from ClearBank should be disabled and the virtualAccountId custom field value from Mambu should be updated by adding a [Disabled] prefix.

The following data is required for manually executing the main process for Disable virtual account:

{

"loanAccountId": "Mambu loan account ID"

}

Please Note:

- Where the loan account state is

Closed - RefinancedorRescheduled, a new loan account is created which has the samevirtualAccountIdandIBANas the previous loan account. For statesClosed (Withdrawn)orRejectedthe disbursement is not done yet and the account is stillPending Approval. - The process can also be manually triggered for any other closed loan account states.