FPS and CHAPS

The Clearing House Automated Payment System (CHAPS) provides a limited faster-than-Bacs service for high value transactions, while the Faster Payments Service (FPS) is focused on a larger number of smaller payments.

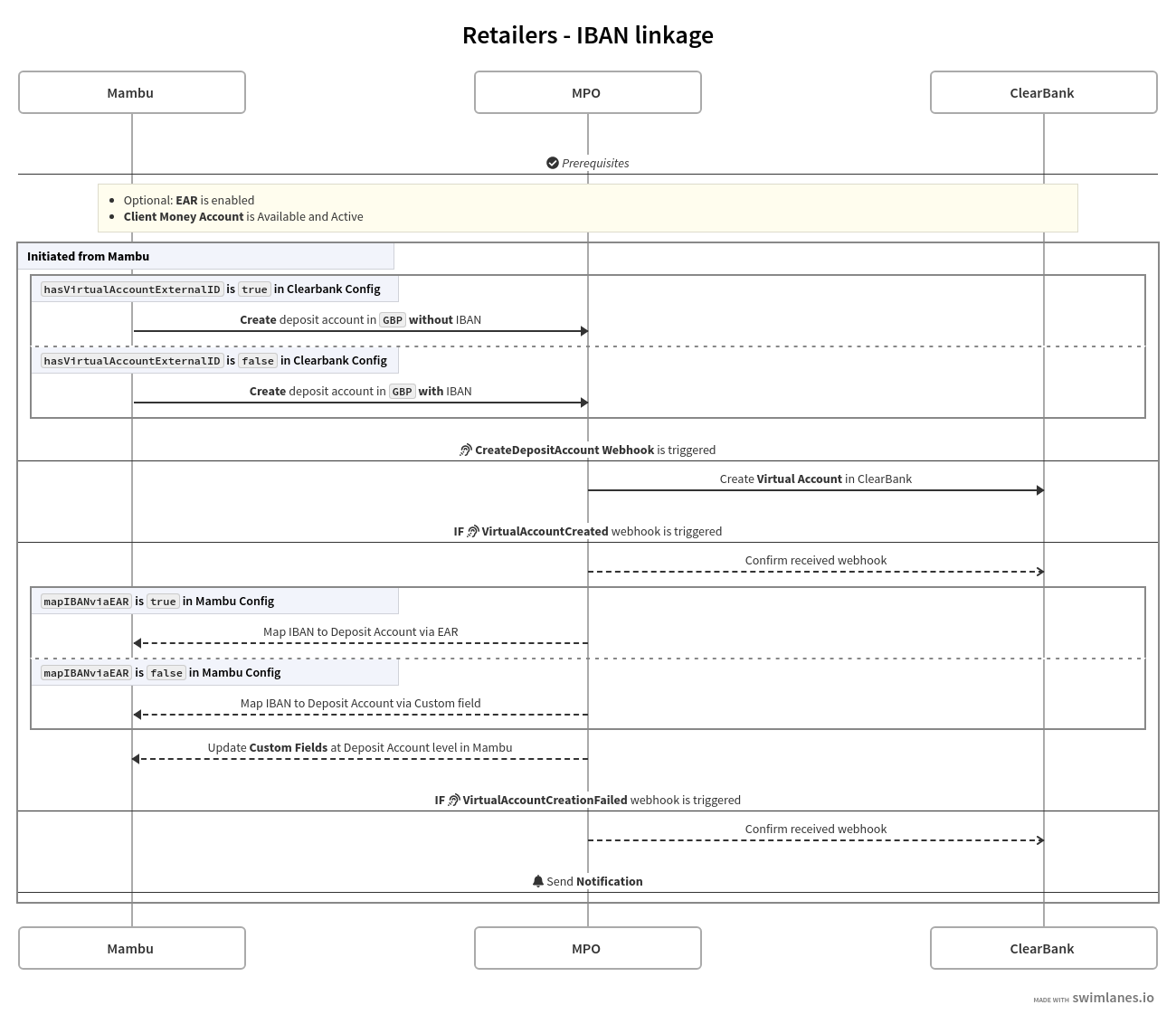

IBAN linkage

Outbound payment

The process is automatically triggered when a new Deposit Account is created in Mambu, and the Deposit Account Created webhook is sent to MPO.

The purpose of the IBAN linkage [link to Mambu webhook(s)] main process is to create a Virtual Account, then link the ClearBank IBAN to it, and lastly map the IBAN to the Mambu Deposit Account. At the deposit account level the following ClearBank account details - virtualAccountID, sortCode, accountNumber and IBAN - are also mapped into custom fields.

Please Note:

- The

IBANvalue is mapped to the Deposit Account custom field regardless of the the linkage method (EAR or Custom Field) used. - Only one Virtual account should be linked to a Deposit Account in a 1:1 relationship.

- Only one IBAN can be mapped to a Deposit Account in a 1:1 relationship.

- The ClearBank webhooks triggered are

VirtualAccountCreationFailedandVirtualAccountCreated.

It is important to note the following:

- When the

hasVirtualAccountExternalIDproperty is set to:truein ClearBank config: An IBAN is automatically generated by ClearBank based on the unique external identifier provided and matches ClearBankX-Request-ID. The IBAN generated is used to create the Virtual Account that is linked to Mambu Deposit Account.falsein ClearBank config: An IBAN must have been previously generated and linked to the Mambu Deposit Account.

- When

hasVirtualAccountExternalIDis set totrueand an IBAN is also provided at Deposit Account Creation, a Notification is sent due to conflicting IBAN generation. - When the

clearBankAccountSetupproperty has the valuesingleRAthe linkage must be skipped as no IBAN is mapped at Deposit Account level, and Virtual Account feature is not used from ClearBank.

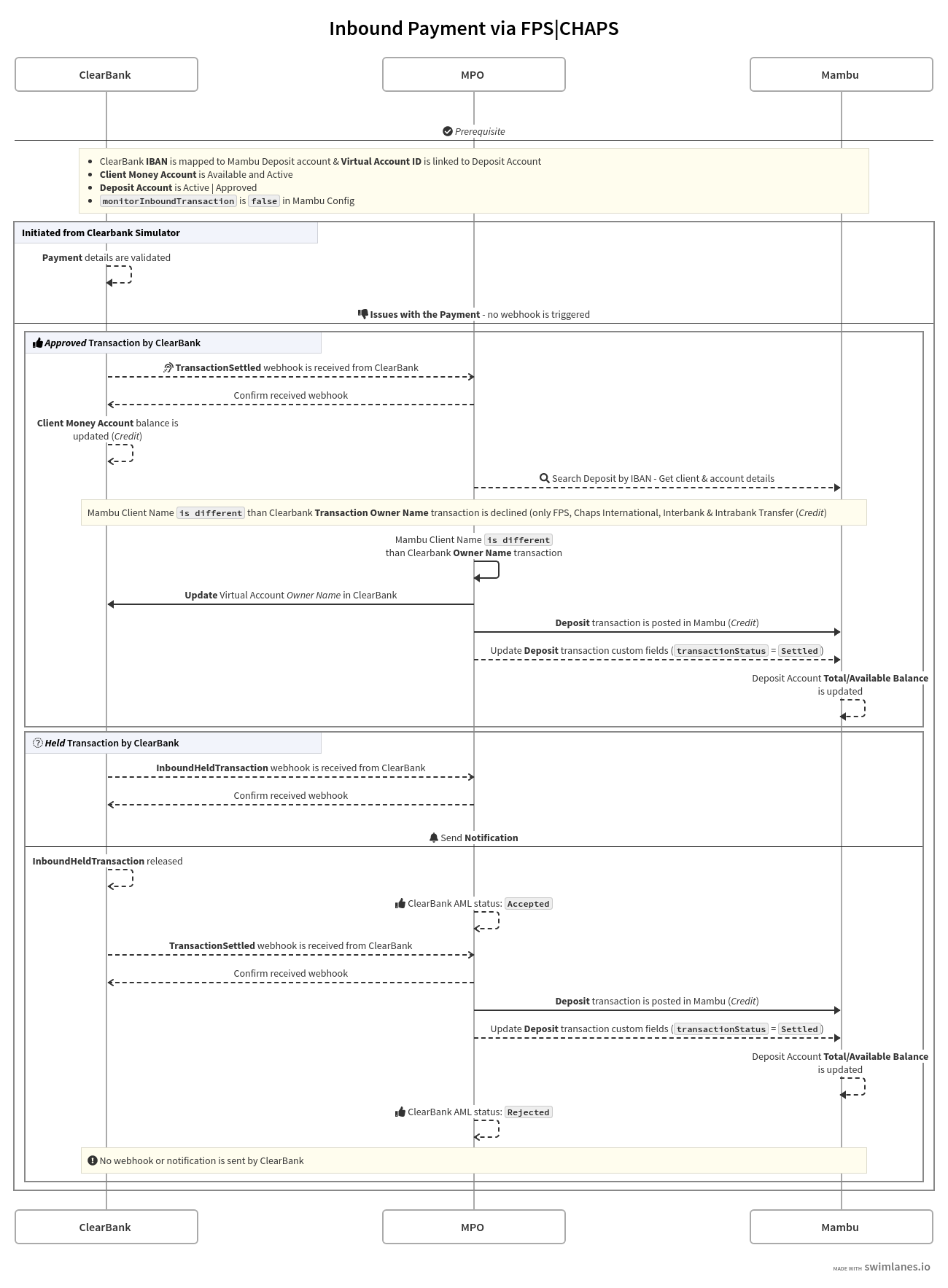

Inbound payment

This template allows you to initiate inbound transactions using an external account for existing Mambu clients that have Mambu deposit accounts using the UK payment schemes FPS and CHAPS. The ClearBank webhooks that can be triggered for Inbound flow are TransactionSettled and InboundHeldTransaction.

The Deposit Scheme Router [triggered by MPO webhook receiver] Mambu Process Orchestrator (MPO) process is automatically triggered when a payment is initiated from the ClearBank Portal Simulator and the TransactionSettled webhook is received in MPO. The purpose of Deposit Scheme Router [triggered by MPO webhook receiver] main process is to decide if the payment made from ClearBank should be routed to payment scheme FPS or CHAPS.

Once the payment scheme is known, the Inbound Payment process is triggered where the Deposit Account and Mambu customer are identified based on the value stored in ClearBank config for the clearBankAccountSetup parameter as follows:

- For

VA: The IBAN provided inTransactionSettledwebhook sent by ClearBank is used for identification. - For

singleRA: The payment reference provided inTransactionSettledwebhook sent by ClearBank is used for identification.

Based on the payment scheme the following validations are made:

- FPS: If

confirmationOfPayeeis set totruein ClearBank config, the following validation is made:- only when Mambu Client Name

equalsto ClearBank Transaction Owner Name the payment is processed. - Otherwise, if

confirmationOfPayeeis set tofalsethis validation is skipped. After this validation, if the Mambu Client Nameis differentto ClearBank Owner Name, the Virtual Account owner is updated in ClearBank with the Mambu Client Name. TheMambu Deposit [Inbound Payment]MPO process is triggered once these validations are successful. If the Mambu Client Nameis differentto ClearBank Transaction Owner Name the payment is declined. This logic also applies to Inbound Interbank payments, Chaps International payments and Outbound Intrabank Transfer (Only Credit).

- only when Mambu Client Name

- Chaps: The following validation is made:

- If the Mambu Client Name

equalsto ClearBank Owner Name, the payment is directly processed andMambu Deposit [Inbound Payment]MPO process is triggered. - If they are

different, first the Virtual Account owner is updated in ClearBank with the Mambu Client Name and after that the flow continues.

- If the Mambu Client Name

When clearBankAccountSetup has the value singleRA the name validations are skipped (Mambu Client Name vs. ClearBank Transaction Owner Name) for all schemes. The config parameter transactionSingleAccount is required when clearBankAccountSetup is set to singleRA. If clearBankAccountSetup is set to singleRA and transactionSingleAccount is empty or missing, the setup process will fail. The transactionSingleAccount parameter specifies which ClearBank account’s IBAN will be used for all the transactions: OA - Operating Account or CMA - Client Money Account.

In Mambu, a Deposit transaction is posted under a dedicated Transaction Channel based on the payment scheme: CB_Deposit_FPS or CB_Deposit_CHAPS, and transaction details are pushed into custom fields (transactionStatus is updated to Settled).

If the amount requested to be transferred is greater than GBP1000000 and the payment scheme used is FPS, the request will be rejected by the MPO router Deposit Scheme Router [triggered by MPO webhook receiver], as the maximum allowed amount for FPS has been exceeded. In this case the payment is reversed in ClearBank by posting a new Outbound payment.

Please Note:

- The

Deposit Scheme Router [triggered by MPO webhook receiver]MPO process is triggered only when aTransactionSettledwebhook is sent by ClearBank. - For

negativecases withsingleRAandVAvalues for theclearBankAccountSetupconfiguration, in order to reverse the payment in ClearBank the customer must have at least one address section field in Mambu populated using the UK address format (for example: United Kingdom, London, Hackney, 55 Testing Road, AB1 2CD). Otherwise, the reverse will fail as the payer address is mandatory for outbound payments. In those cases, manual intervention may be needed. - For

negativecases where the payment is released andTransactionSettledwebhook is sent by ClearBank, but due to other issues the Deposit transaction is not posted in Mambu - a notification is sent based on theNotification Setupconfiguration. After the notification is analyzed and payments details are know, these are the options:- When the payment in ClearBank is reversed, by posting a new Outbound payment, and if all the details are provided (identified by a specific empty error message: for example,

Inbound Reversal error: []): The reversed inbound payment can be identified in ClearBank by the payment referenceInbound Reversed. - When

clearBankAccountSetuphas the valuesingleRAand the payment in ClearBank is reversed, by posting a new Outbound payment, and if all the details were provided (identified by a specific empty error message: for example,Inbound Reversal error: []): The reversed inbound payment can be identified in ClearBank by the payment reference[depositAccountID]-REV. If the Mambu Deposit Account contains numbers then all the outbound CHAPS payment will be first held in ClearBank and the flow will continue once the payment is released by ClearBank. - If the Inbound Reverse fails (identified by a specific error message), manual intervention might be needed after the root cause is identified.

- When the payment in ClearBank is reversed, by posting a new Outbound payment, and if all the details are provided (identified by a specific empty error message: for example,

- If a

Deposittransaction needs to be manually posted in Mambu after the payment is released andTransactionSettledwebhook is received, the following transaction channelsCB_Deposit_FPSorCB_Deposit_CHAPSshould be used as the payment already exists in ClearBank. - When the

monitorInboundTransactionkey is set totruethe transaction will be monitored and posted also in FinCrime module. - When config parameter

clearBankAccountSetuphas the valuesingleRA, transactions cannot be monitored by using an AML extension. Transactions can only be monitored for option theVA, the Virtual Account feature from ClearBank. The Paymentreferencefield must contain the Deposit Account ID from Mambu to be able to identify the account. - The ClearBank webhooks

VirtualAccountCreated,VirtualAccountCreatedFailed, andTransactionRejecteddon’t have a reference field.

Inbound Held payment

Following an Inbound Held payment the webhook TransactionSettled may be received if the payment passes ClearBank’s sanction screening check:

- InboundHeldTransaction:

False Positive: The payment is released.True Positive: The payment remains under investigation.

The InboundHeldTransaction ClearBank webhook is triggered only when a payment is suspended and analysis is required by ClearBank. The payment payload is stored in Inbound Payment Webhook MPO state diagram. An Info notification is sent, based on the Notification Setup configuration, with a specific message regarding the held payment in ClearBank.

If after analysis the result is False Positive, the payment is released by ClearBank, a TransactionSettled webhook is sent, and Deposit Scheme Router [triggered by MPO webhook receiver] MPO process is triggered. InboundHeldTransaction and TransactionSettled webhooks are matched by the EndtoEndTransactionID in ClearBank.

If the result is True Positive, the payment will be re-routed to the held suspense account until more instructions are received, and no TransactionRejected webhook is by ClearBank. An Inbound Held transaction is not available in ClearBank UI or API.

Inbound Reversal - FPS

Following a FasterPayments reversal, three TransactionSettled webhooks may be received (matched by the EndtoEndTransactionID in ClearBank). One for each of the following stages:

- First Credit, when

isReturn:false - Debit (reversal), when

isReturn:true - Second Credit (retry), when

isReturn:false

After an inbound payment is sent and TransactionSettled (First Credit, when isReturn:false) webhook is acknowledged and the Inbound flow is successfully executed - a Deposit transaction is created in Mambu. If the FasterPayments scheme does not respond in less than 30 sec the transaction will be automatically reversed by the scheme. This action is reflected by receiving the second TransactionSettled (Debit -> isReturn:true) webhook in MPO . This second webhook is stored in the MPO process Inbound Payment Webhook for 30 minutes.

If the reversal scheme process is:

- Successful: The FPS scheme

retryis triggered, which implies that the thirdTransactionSettled(Second Credit-isReturn:false) webhook is sent by ClearBank. This webhook is acknowledged and stored inInbound Payment Webhook, since no action is required. - Unsuccessful: If the third webhook is not sent after 30 minutes, the reversal process is automatically triggered by readjusting the

Deposittransaction in Mambu, since the Inbound payment in ClearBank is already reversed.

Please Note:

Inbound Reversalonly applies to the FPS scheme.- If the FPS scheme sends the third

TransactionSettled(Second Credit - isReturn:false) webhook after 30 minutes, this webhook is stored inInbound Payment WebhookMPO state diagram and then a notification is sent. As manual reconciliation is needed you need to manually post a Deposit transaction in Mambu using the payment details from ClearBank andMBU_Deposit_FPSas the transaction channel, since the payment already exists in ClearBank. - The third

TransactionSettledwebhook (Second Credit - isReturn:false) might be aSingle Immediate Payment, with the suffix:10, and in this case is sent almost immediately, or aForward Dated Payment, with the suffix:40, and in this case it can be sent hours or days later.

International Inbound Payment - CHAPS

International Inbound CHAPS payments, which have originated overseas, are received in GBP from the originating bank’s correspondent in the UK. The Inbound Payment Webhook MPO process decides if the inbound payment is domestic or international.

International CHAPS payments cannot be automatically reversed, therefore a notification is sent and ClearBank needs to be contacted for more detail. The Customer Care team will need to return the funds manually on the client’s behalf.

Please Note:

- When the config parameter

clearBankAccountSetuphas the valuesingleRA, the Creditor Reference must contain the Mambu Deposit Account - otherwise the payment will fail. - When

Supplementary Datais enabled on ClearBank environment, the config propertyisSupplementaryDataUsedis set totrue, and the debtor IBAN is not sent inTransactionSettledwebhook (CounterpartAccount), the concatenated values of BIC and Account Number will be mapped into the Mambu custom fielddebtorIBAN- instead of the default textNOT PROVIDED. These values are read fromTransactionSettledwebhookSupplementary Dataobject (with or without an AML extension). If the Account Number cannot be extracted from the CHAPS supplementary data field because it was not sent, only BIC will be mapped into thedebtorIBANfield.

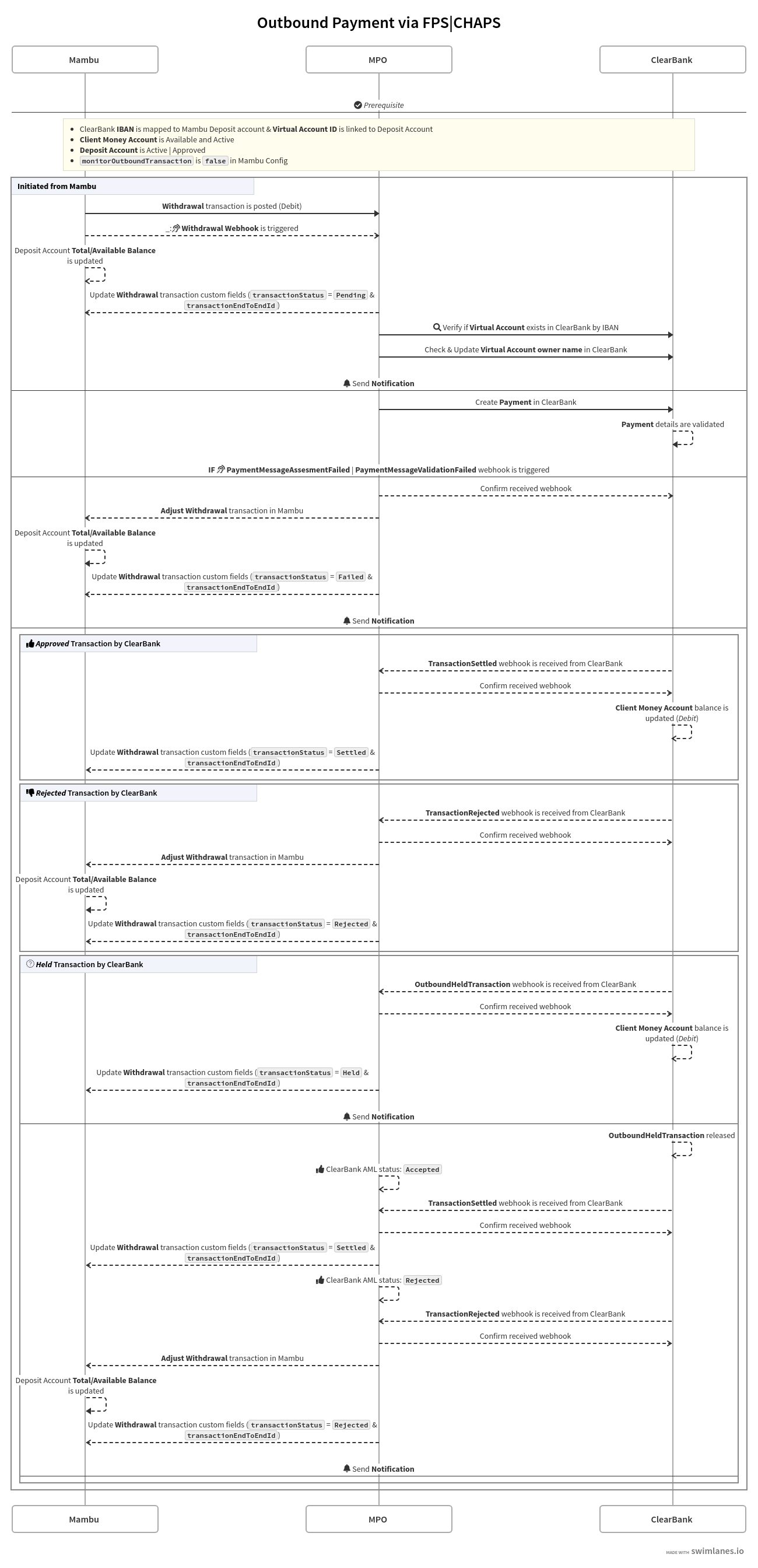

Outbound payment

This template allows you to initiate outbound transactions using an external account for existing Mambu clients that have Mambu deposit accounts, using the UK payment schemes FPS and CHAPS.

The ClearBank webhooks that may be triggered for outbound flow are: TransactionSettled, OutboundHeldTransaction, PaymentMessageAssesmentFailed, PaymentMessageValidationFailed, and TransactionRejected.

The Withdrawal Scheme Router [link to Mambu webhook] process is automatically triggered when a Withdrawal transaction is initiated from Mambu using a dedicated Transaction Channel based on the payment scheme. The MBU_Withdrawal_FPS or MBU_Withdrawal_CHAPS, and Withdrawal webhooks are sent to MPO.

The purpose of the Withdrawal Scheme Router [link to Mambu webhook] main process is to decide if the payment meets the following conditions based on the value stored in ClearBank config for the parameter clearBankAccountSetup:

- For

VA: An IBAN must be mapped to the deposit account, payment scheme isFPS/CHAPS, and deposit account currency isGBP. If the conditions are not met then the Withdrawal is adjusted in Mambu a notification is sent based on theNotification Setupconfiguration. - For

singleRA: The payment reference must contain the debtor deposit account ID from Mambu. The payment reference field is automatically populated with Mambu Deposit Account value sent from the Withdrawal webhook details if it is sent empty.

Please Note:

- At least one address section field must be populated, using the UK address format (for example: United Kingdom, London, Hackney, 55 Testing Road, AB1 2CD), for the customer in Mambu for withdrawal transactions with

singleRAandVAvalues forclearBankAccountSetupconfiguration. - The minimum required fields that need to be sent when a withdrawal transaction is initiated in order to have a successful outbound payment are:

creditorIBANcreditorName

- If the debtor address provided is greater than 140 characters for FPS or 105 characters for the CHAPS payment scheme, the debtor address is trimmed from the right-hand end until the length of debtor address is within the character limits. Country and city must always be visible.

The paymentReference field is optional in ClearBank. The debtorIBAN and debtorName are optional as they are automatically populated with Mambu client details once the Withdrawal webhooks are received in MPO.

Once the payment scheme is known and IBAN linkage is verified, then the Withdrawal [Outbound Payment] process is triggered. The ClearBank [Outbound Payment] process is triggered only when Deposit Account, Mambu client details, and ClearBank Virtual Account are validated using the IBAN provided in the Withdrawal webhook details. Based on the payment status ClearBank can send one of the following webhooks as response:

accepted: In ClearBankTransactionSettled.rejected: In ClearBankTransactionRejected.held: In ClearBankOutboundHeldTransaction.- Payment details validation fails: In ClearBank

PaymentMessageAssesmentFailedorPaymentValidationAssesmentFailed.

ClearBank Virtual Account validation using the IBAN provided in the Withdrawal webhook details is skipped when singleRA is used for all the transactions, since the Virtual Account feature is not used.

The initial transactionStatus value after the Withdrawal webhook is sent is Pending. Once the payment is processed in ClearBank, based on the ClearBank webhook type the transactionStatus can transition to one of the following statuses:

TransactionSettledwebhook =transactionStatus=SettledTransactionRejectedwebhook =transactionStatus=RejectedOutboundHeldTransactionwebhook =transactionStatus=HeldPaymentMessageAssesmentFailedorPaymentValidationAssesmentFailedwebhook =transactionStatus=Failed- Payment is rejected at API level or did not reached ClearBank =

transactionStatus=API_Rejected

If the amount requested to be withdrawn is greater than GBP1000000 and the payment scheme used is FPS, the request will be rejected by the MPO router Withdrawal Scheme Router [link to Mambu webhook] as the maximum allowed amount for FPS has been exceeded. In this case the Withdrawal transaction will be adjusted in Mambu.

Please Note:

- If the

Withdrawaltransaction is not posted using the correct transaction channel, the MPO process will not be triggered. - If the

Adjusted Withdrawalfails a notification is sent based on theNotification Setupconfiguration. After the root cause of the failure is known and the payment is identified in ClearBank, the adjustment needs to be manually performed in Mambu. - CHAPS payments which use numbers in the

Referencefield are automaticallyHeldin ClearBank in order to be analyzed and released by ClearBank once the analysis is finished. See the Outbound Held Payment flow section. - Accepted values for

creditorIBANfield: UK IBAN default format (GB68HBUK40478470872490), country specific IBAN (GBR40478470872491), or sort code and account number (40478470872490). - When the key

monitorOutboundTransactionis set totrue, the transaction will also be monitored and posted in the FinCrime module. - When

singleRAis used, all the outbound transactions are stored first in theWebhook Retailers for Transaction Rejected Receiver SDstate diagram to be able to identify the deposit account ID for Rejected transactions by ClearBank. Payment reference field is not sent in TransactionRejected webhook sent by ClearBank.

Outbound Held payment

Following an Outbound Held payment two webhooks can be sent by ClearBank, based on the sanction screening check result: TransactionSettled or TransactionRejected.

- OutboundHeldTransaction:

False Positive: The payment is released.True Positive: The payment remains under investigation.

The webhook OutboundHeldTransaction is triggered only when a payment is suspended in ClearBank and analysis is required. The payment payload is stored in Outbound Payment Webhook MPO state diagram. The transactionStatus custom field value is updated from Pending to Held for Mambu Withdrawal transactions, and an Info notification is sent, based on the Notification Setup configuration, with a specific message regarding the held payment in ClearBank.

If after the analysis the result is False Positive, the payment is released by ClearBank and a TransactionSettled webhook is sent, which is processed in Outbound Payment Webhook MPO process. The transactionStatus custom field value is updated from Held to Settled for Mambu Withdrawal transactions.

If ClearBank rejects a held transaction, then a TransactionRejected webhook is sent, the Withdrawal transaction is adjusted and transactionStatus custom field value is updated from Held to Rejected.

If the result is True Positive then the payment will be re-routed to the held suspense account until instructions are received.

Outbound Reversal (FPS)

Following a FasterPayments reversal three TransactionSettled webhooks may be received. One for each of the following stages:

- First Debit, when

isReturn:false. - Credit (reversal), when

isReturn:true. - Second Debit (retry), when

isReturn:false.

After an outbound payment is sent and the webhook TransactionSettled (First Debit, when isReturn:false) is acknowledged and the Outbound flow is successfully executed - transaction exists in ClearBank, if FasterPayments scheme does not respond in less than 30 seconds the transaction will be automatically reversed by the scheme. This action is reflected by receiving in MPO the second TransactionSettled (Credit, when isReturn:true) webhook. This second webhook is stored in MPO process Outbound Payment Webhook for 30 minutes.

If the reversal scheme process is:

- Successful: The FPS scheme

retrywill be triggered, which implies that a thirdTransactionSettled(Second Debit - isReturn:false) webhook is sent by ClearBank. This third webhook is acknowledged and stored inOutbound Payment Webhook, since no action is required. - Unsuccessful: If the third webhook is not sent in 30 minutes, the reversal process will automatically be triggered, by readjusting the

Withdrawaltransaction in Mambu, since the Outbound payment in ClearBank is already reversed.

Please Note:

Outbound Reversalonly applies for the FPS scheme.- If the FPS scheme sends the third

TransactionSettled(Second Debit - isReturn:false) webhook after 30 minutes, this webhook is stored inOutbound Payment WebhookMPO state diagram and a notification is sent as manual reconciliation is needed. TheWithdrawaltransaction needs to be manually posted in Mambu using the payment details from ClearBank andCB_Deposit_FPSas transaction channel, since the payment already exists in ClearBank. - The third

TransactionSettled(Second Debit - isReturn:false) webhook might be aSingle Immediate Payment, with the suffix:10, and is sent almost immediately, or aForward Dated Payment, with the suffix:40, and can be sent in hours or days later. - The pooling mechanism from

Outbound Payment Webhookis triggered as follows:- If a payment is stored in Held state for more than 24 hours.

- If an FPS reversal is triggered and the third webhook (Retry) is not sent in 30 minutes.

- If no webhook arrived in MPO after 30 minutes of waiting for an outbound payment after the initiation was made.

- When the option

VAis used - transactions are searched for a specific Virtual Account and if ClearBank identifier matches the Mambu transaction encoded key then the transaction is considered as found, details are retrieved, and the flow continues. This applies for the use cases Held, FPS reversal, Settled and Rejected transactions - CHAPS and FPS schemes. If the transaction is not found in ClearBank then the flow will stop, a reversal will be triggered, and a notification is sent. - When the option

singleRAis used - transactions are searched by Operating Account or Client Money Account and if the identifier matches the Mambu transaction encoded key then the transaction is considered as found, details are retrieved, and the flow continues. This applies for the use cases Held, FPS reversal, Settled and Rejected transactions. If the transaction is not found in ClearBank then the flow will stop, a reversal will be triggered, and a notification is sent.

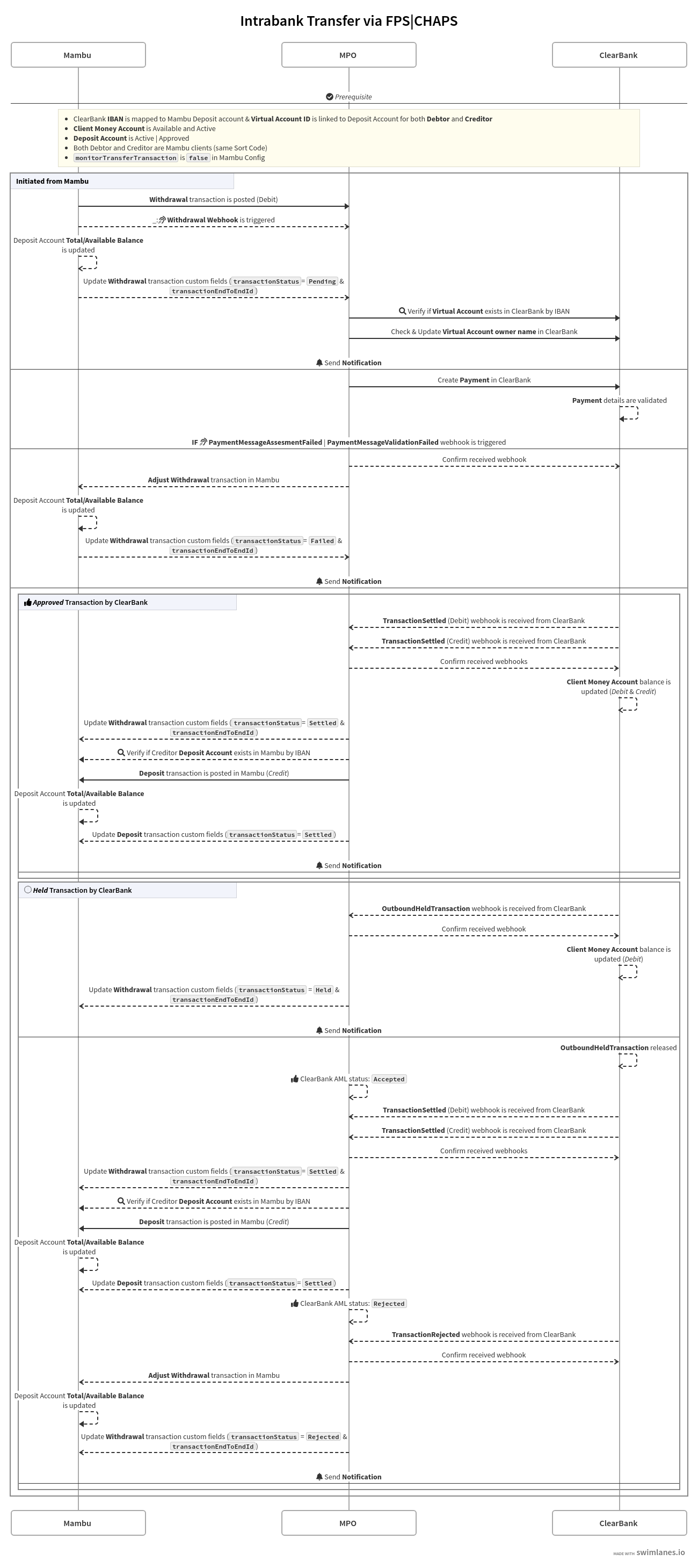

Transfer payment

This template applies for Transfer payments inter-bank (different ClearBank sort codes, but the same institution) initiated as outbound and inbound transaction and intra-bank (same ClearBank sort codes) initiated as outbound transaction using UK payment schemes FPS and CHAPS.

Intrabank payment

When a Withdrawal transaction is initiated from Mambu using the Transaction Channel MBU_Transfer and the creditor IBAN has the same sort code, same bank branch (ClearBank, and belongs to another Mambu client that also has an IBAN linked to ClearBank, a Transfer is posted in ClearBank.

The purpose of Withdrawal Scheme Router [link to Mambu webhook] main process is to decide if the payment meets the following conditions based on the value stored in ClearBank config for the parameter clearBankAccountSetup:

- For

VA: An IBAN must be mapped to deposit account. - For

singleRA: The payment reference must contain the debtor deposit account ID and the creditor deposit account ID (both from Mambu) separated by hyphen:{debtorDepositAccountId}-{creditorDepositAccountId}. Since there is no linkage with any ClearBank IBAN, all the transactions will be made using the same debtor IBAN based on the value stored in fieldtransactionSingleAccount-OA(Operating Account) orCMA(Client Money Account).

Please Note:

At least one address section field must be populated, using the UK address format (for example: United Kingdom, London, Hackney, 55 Testing Road, AB1 2CD), for both the debtor and the creditor in Mambu for withdrawal transactions with singleRA and VA values for clearBankAccountSetup configuration.

TransactionSettled webhooks, which match the EndtoEndTransactionID value in ClearBank: one debit and one credit webhook. If only a debit webhook or a credit webhook arrives and there is a delay before receiving the second webhook, the process waits for a specific amount of time to receive the second webhook. After this time elapses, and if the second webhook does not arrive, the withdrawal transaction is reversed. The time period to wait between webhooks can be configured using the intrabankTransferWaitingTime value.The TransactionSettled (Debit) webhook will be stored in [Outbound Payment Webhook] and the withdrawal transactionStatus custom field value is updated from Pending to Settled. The TransactionSettled (Credit) webhook will be processed further for the transfer flow by first validating the creditor details and, secondly, posting a deposit transaction in Mambu using the CB_Transfer(transactionStatus= Settled) transaction channel.

Both withdrawal and deposit Mambu transactions will have the same transactionStatus and transactionEndToEndId values. If the beneficiary account is Closed or Disabled, ClearBank will send one PaymentMessageValidationFailed webhook, the Withdrawal in Mambu will be adjusted, and the transactionStatus will be updated from Pending to Failed.

Please Note:

- The intrabank payment is only processed when both the debit and the credit webhooks are received and acknowledged.

- An intrabank transfer can be held in ClearBank. See Outbound Held Payment flow section.

- If an intrabank transfer is held and released as rejected, then only one

TransactionRejectedwebhook will be sent. - If the deposit transaction fails, then the withdrawal transaction will be adjusted in Mambu and in ClearBank. The adjustment needs to be done manually for transfer payments.

- When the

monitorIntraBankTransferTransactionkey is set totrue, the transaction will be also monitored and posted to the FinCrime module (this also applies toInterbank Transfer). - If the debtor address provided is greater than 140 characters for FPS or 105 characters for the CHAPS payment scheme, the debtor address is trimmed from the right-hand end until the length of debtor address is within the character limits. Country and city must always be visible.

Outbound Interbank payment

When a Withdrawal transaction is initiated from Mambu using the Transaction Channel: MBU_Transfer and the creditor IBAN has a different sort code and the same bank branch (ClearBank) - a Transfer is posted in ClearBank.

Based on the value of parameter clearBankAccountSetup from ClearBank config the following logic applies:

- For

VA: An IBAN must be mapped to deposit account. - For

singleRA: The payment reference must contain the debtor deposit account ID from Mambu. If the payment scheme isMBU_Transfer, the payment reference must also contain the creditor deposit account ID from Mambu.

After payment details are validated, ClearBank will send one TransactionSettled webhook for Debit which will be stored in Outbound Payment Webhook MPO process, and the transactionStatus will be updated from Pending to Settled.

If the beneficiary account is Closed or Disabled, ClearBank will send one TransactionRejected webhook and the Withdrawal in Mambu will be adjusted.

Please Note:

At least one address section field must be populated, using the UK address format (for example: United Kingdom, London, Hackney, 55 Testing Road, AB1 2CD), for the debtor in Mambu for withdrawal transactions with singleRA and VA values for clearBankAccountSetup configuration.

If the debtor address provided is greater than 140 characters for FPS or 105 characters for the CHAPS payment scheme, the debtor address is trimmed from the right-hand end until the length of debtor address is within the character limits. Country and city must always be visible.

Inbound Interbank payment

When an Inbound payment is initiated from a different ClearBank institution and the debtor IBAN has a different sort code, but same bank branch (ClearBank) - a Transfer is posted in ClearBank.

After payment details are validated, ClearBank will send one TransactionSettled webhook for Credit, which will be stored in Inbound Payment Webhook MPO process. The transactionStatus will be updated from Pending to Settled. A Deposit transaction is posted in Mambu using the Transaction Channel: CB_Transfer.

If the beneficiary account is Closed or Disabled, ClearBank will send one TransactionRejected webhook and the Deposit transaction in Mambu will not be posted.

When Supplementary Data is enabled on ClearBank environment and the config property isSupplementaryDataUsed is set to true and if the debtor IBAN is not sent in TransactionSettled webhook (CounterpartAccount), the concatenated values of BIC and Account Number will be mapped into Mambu custom field debtorIBAN - instead of the default text NOT PROVIDED. These values are read from TransactionSettled webhook Supplementary Data object (with or without the AML extension). If Account Number cannot be extracted from CHAPS supplementary data field, because it was not sent, only BIC will be mapped into the debtorIBAN field.

Please Note:

- The sequence diagrams from

OutboundandOutboundflows are applicable toInterbanktransfers. - When the

monitorOutboundTransactionkey is set totrue, theoutboundinterbank transaction will be monitored and posted to the FinCrime module. - If the

Adjusted Withdrawalfails, a notification is sent based on theNotification Setupconfiguration. After the cause of the failure is known and the payment is identified in ClearBank the adjustment needs to be manually done in Mambu. - An

Interbanktransfer can beHeldin ClearBank. See the Outbound/Inbound Held Payment flow sections. - When the

monitorInboundTransactionkey is set totrue, theinboundinterbank transaction will be monitored and posted to the FinCrime module.

Monthly ClearBank charges

In ClearBank there are two types of charges applicable to the financial institution:

- Transaction charges

- Monthly charges

Monthly Charges are handled in the connector as follows. When ClearBank sends a TransactionSettled webhook with field Scheme = Transfer and field Reference = ClearBank Charges, the webhook is acknowledged and processed in the connector in Outbound Payment Webhook process. When the property skipAccountingForCharges is set on:

false: In Mambu config, one manual journal entry is logged in Mambu:Debit- ClearBank Charges GL andCredit- Scheme GL.true: In Mambu config, the accounting is managed by the client and from the connector a notification as [INFO] is sent accordingly - based on the Notification setup.

Please Note:

- ClearBank do not provide the IBAN in the ‘CounterPart’ to show where the monies are being collected to within ClearBank in this type of webhook.

- If posting the accounting in Mambu fails, a notification will be sent with the error message - based on the Notification setup.