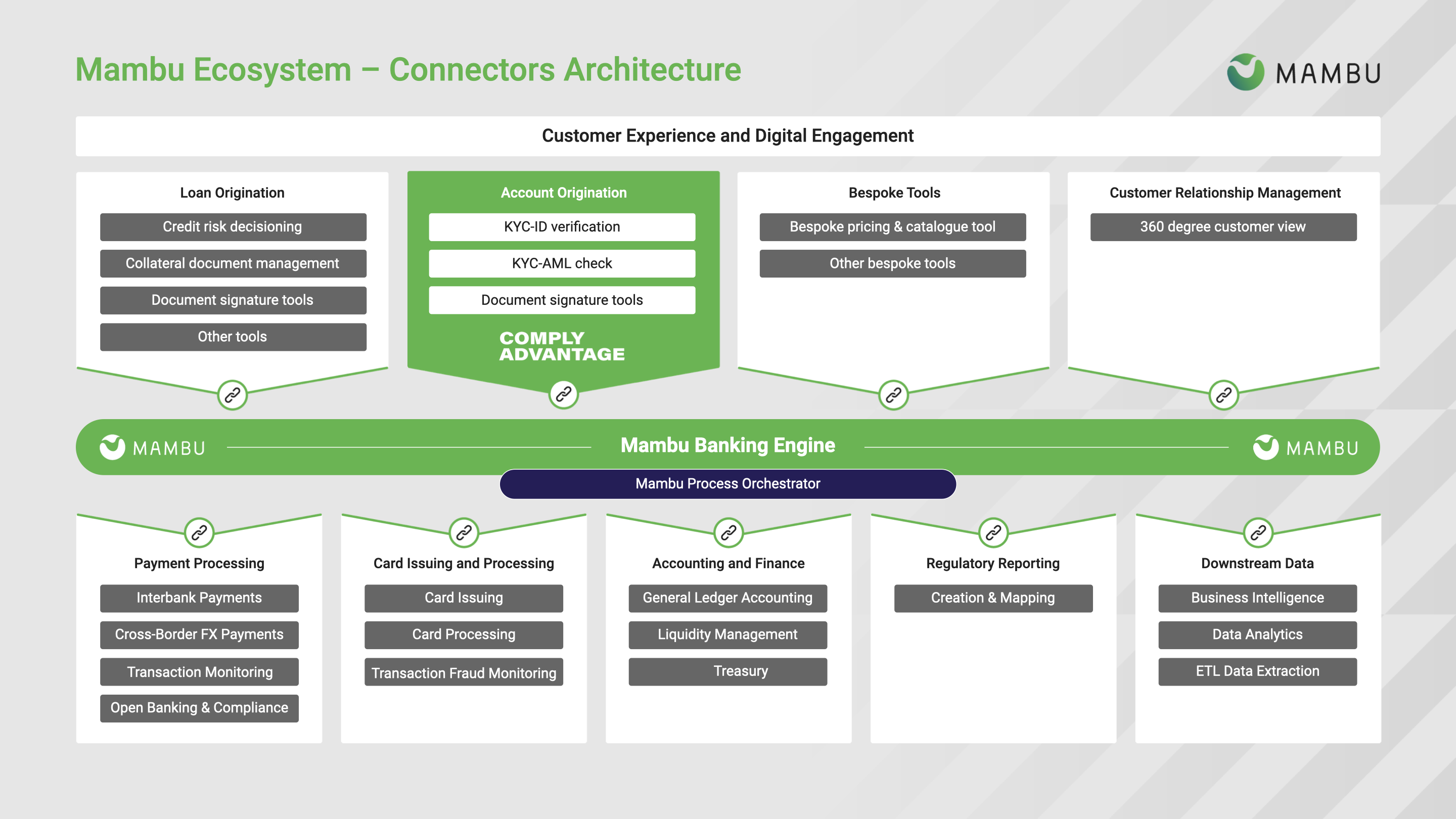

ComplyAdvantage AML Screening and Monitoring

ComplyAdvantage’s customer screening solution helps financial institutions make intelligent decisions in complying with regulations related to Sanctions, Anti-Money Laundering (AML), and Countering the Financing of Terrorism (CFT).

ComplyAdvantage provides automated and ongoing risk monitoring by customizing screening profiles to an institution’s risk-based approach. Coverage of Sanctions, Politically Exposed Persons (PEP), and Adverse Media works through a case management system that allows institutions to provide a tailor-made and cost-effective customer onboarding.

As an optional extra, this connector may also allow you to store details about potential matches by configuring custom fields for AML, Sanctions, Adverse Media and PEP screening in Mambu.

You can find more details about ComplyAdvantage on the Mambu marketplace. ComplyAdvantage is present in 40 countries and has a physical presence in the United Kingdom and the US.

Connector scope

ComplyAdvantage is an Anti-Money Laundering (AML) compliance solution which uses real-time financial crime insight to stay in control and keep pace with regulation. AML Screening and Monitoring solutions enable our clients in the banking sector to better identify risk by using real-time identification and monitoring of suspicious entities against Sanctions, Watchlists, Politically Exposed Persons (PEPs), and Adverse Media.