Connector Architecture

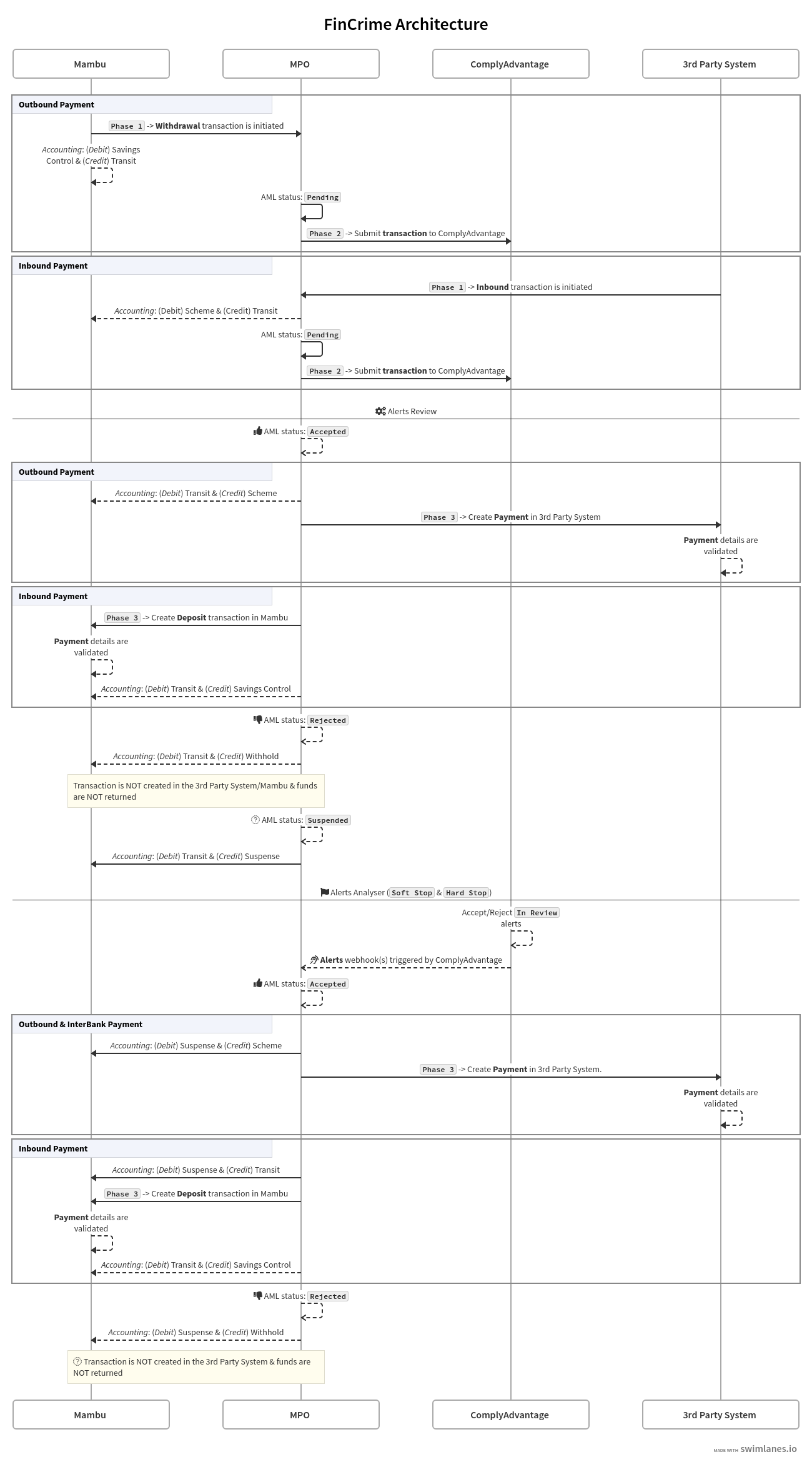

When a monitored payment reaches Mambu Process Orchestrator (MPO), the process Payment Receiver Router is triggered and the payment payload is sent to ComplyAdvantage for analysis.

Transactions are monitored using a comprehensive rule-set defined in ComplyAdvantage, which monitors organizational data based on suspicious activity patterns and stops high-risk transactions as they occur. After the payment analysis, ComplyAdvantage responds with the results of the alert rules, either with Soft Stop, Hard Stop, or passed rules. Depending on these results, the MPO connector determines the AML status of the payment as Accepted, Rejected, or Suspended.

An Accepted payment is allowed to proceed for further processing, a Rejected payment is stopped, and Suspended payments are held for review in ComplyAdvantage. If an alert triggered by a payment is Accepted or Rejected the review result is sent to MPO. The Alerts Analyser Router [to be linked to CA] process receives the review result and, after all alerts triggered by a Suspended payment are reviewed in ComplyAdvantage, sends the status to a third-party system. Based on the status received, this system will determine whether to process the payment.

The architecture of the Anti-Money Laundering (AML) transaction monitoring connector is displayed in the sequence diagram:

Please Note:

More details on the flows can be found in the Business flows section.