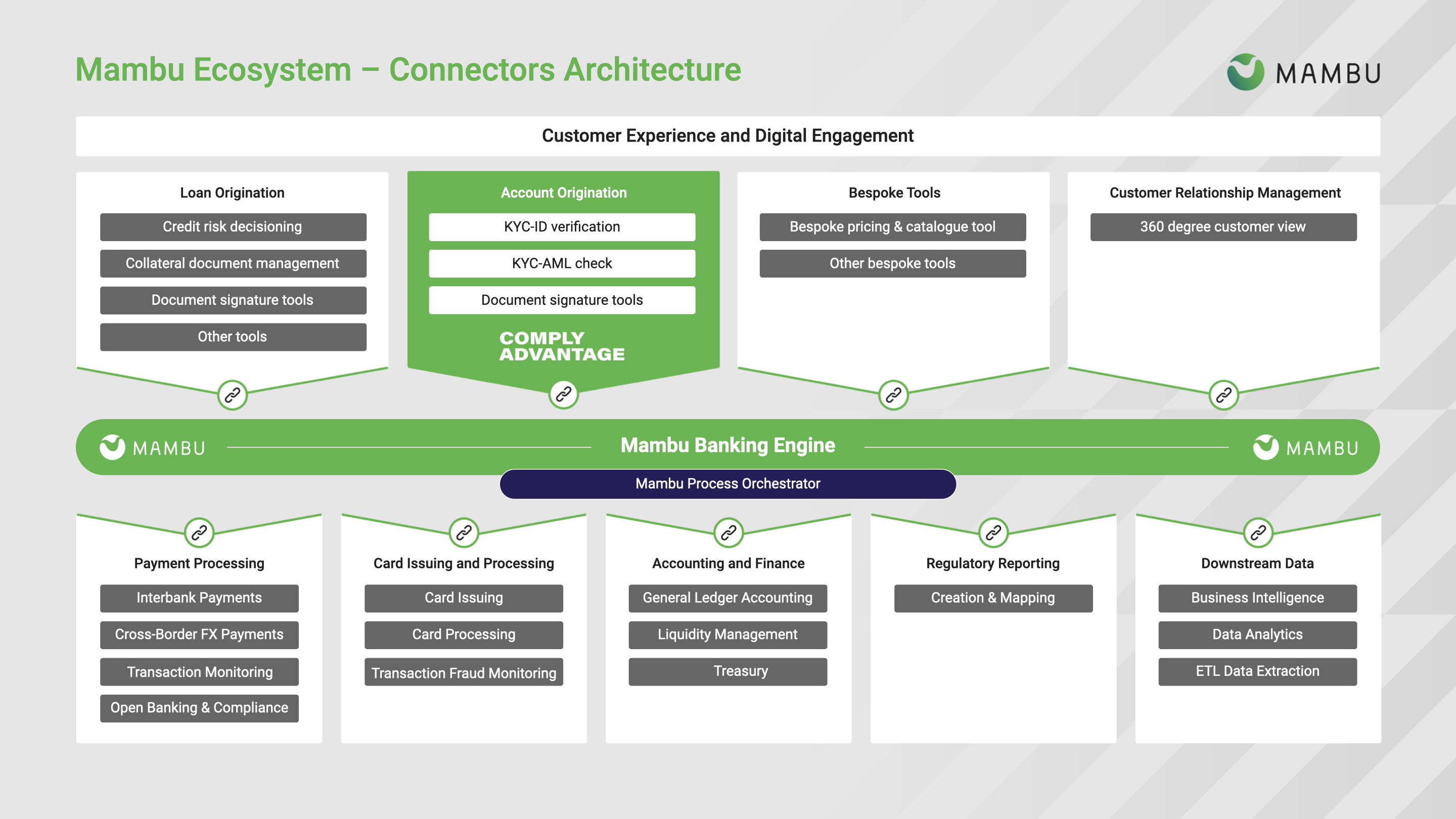

ComplyAdvantage AML for payment source Mambu Payment Gateway

ComplyAdvantage allows you to set up comprehensive rule-sets to monitor transactions in real time, screening senders and beneficiaries against a consolidated worldwide database.

You can find more details about ComplyAdvantage on the Mambu marketplace. ComplyAdvantage is present in 40 countries and has a physical presence in the United Kingdom and the USA.

Connector scope

The connector allows transaction monitoring via ComplyAdvantage when using the Mambu Payment Gateway to process incoming and outgoing (both credit transfer and direct debit) SEPA payments. This helps you to identify suspicious payments and immediately block payments for actors who have been identified as being involved in financial crime.

The connector handles suspense processing for the payments where alerts are raised by the Anti-Money Laundering (AML) system. It also gives bank administrators the ability to approve or reject the payment, based on which the connector can either block or allow further processing of the payment.