Business Flows

Transaction monitoring is the processing of transactions against a series of rules to look for suspicious or fraudulent activity. The Payment Receiver Router [linked to Mambu Payment Gateway] process is automatically triggered when an incoming or outgoing transaction is initiated from Mambu or another system and reaches the Mambu Payment Gateway (MPG).

The purpose of the Payment Receiver Router [linked to Mambu Payment Gateway] process is to determine if the transaction received is a Credit Transfer or a Direct Debit. If the payment direction (incoming or outgoing) received is invalid then the error message is stored in the Error Handling -[TM] state diagram, a notification is sent if the flag submitTransaction is set to true in the notification configuration and the AML Rejected status is sent to the MPG. For bulk payments, each transaction is sequentially processed and the Anti-Money Laundering (AML) status is received and individually sent back to the MPG.

Once the transaction details are read and processed in the Submit transaction [to ComplyAdvantage and Payment Gateway] process, the transaction details are sent to ComplyAdvantage - which sends back the results for the rules configured in the ComplyAdvantage environment. Depending on the alert types received, the AML status of either Accepted or Suspended is sent back to the MPG.

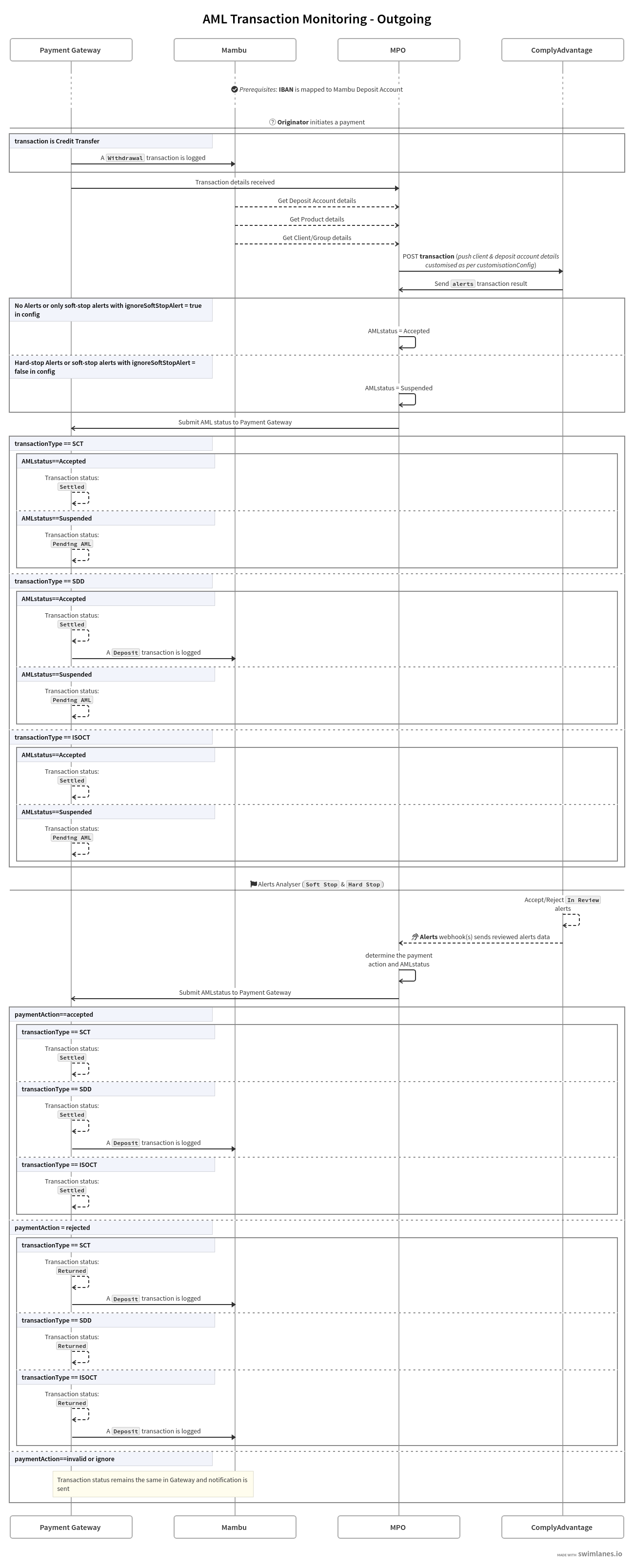

Outgoing payment

Credit Transfer

When an outgoing payment reaches the MPG, a withdrawal transaction is automatically posted in Mambu. The MPG also triggers the Payment Receiver Router [linked to Mambu Payment Gateway] process. After the transaction is posted and monitored in ComplyAdvantage, based on the alert status, the AML status can be: Accepted or Suspended. This status is sent back to the MPG and for:

Accepted: the status is updated accordingly in the MPG.Suspended: once all the alerts are transitioned fromIn Reviewto an end state ofAcceptedorRejected, webhooks are sent by ComplyAdvantage that automatically trigger theAlerts Analyser Router [to be linked to CA]process. The AML status is updated in the MPG, which handles the settlement. If the payment is rejected, a deposit transaction is posted in Mambu, by the MPG, in the debtor’s account.

Direct Debit

When an outgoing payment reaches the MPG, the Payment Receiver Router [linked to Mambu Payment Gateway] process is automatically triggered. After the transaction is posted and monitored in ComplyAdvantage, based on the alert status, the AML status can be: Accepted or Suspended. This status is sent back to the MPG:

Accepted: a deposit transaction is posted in Mambu.Suspended: once all the alerts are transitioned fromIn Reviewto an end state ofAcceptedorRejected, webhooks are sent by ComplyAdvantage that automatically trigger theAlerts Analyser Router [to be linked to CA]process. The AML status is updated in the MPG, which handles the settlement. If the payment is accepted, a deposit transaction is posted in Mambu, and if it is rejected, no transaction is posted in Mambu.

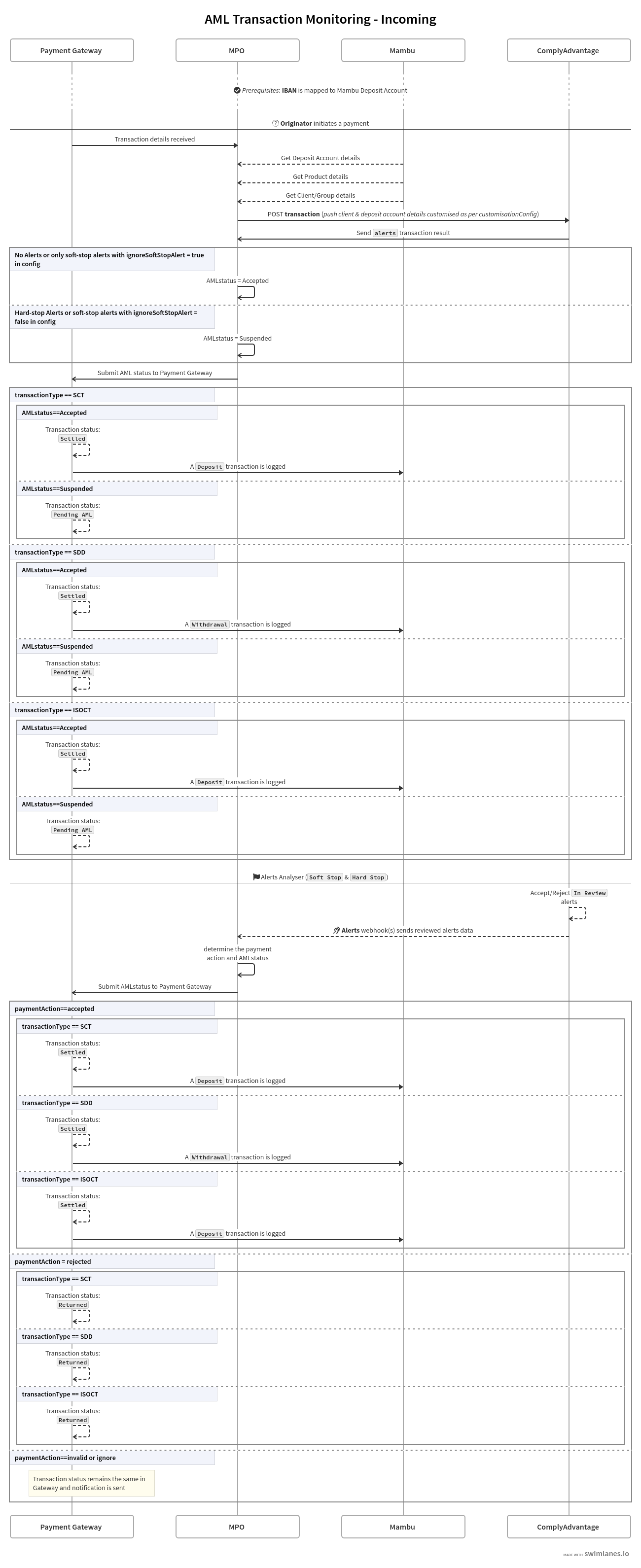

Incoming payment

Credit Transfer

When an incoming payment reaches the MPG, the Payment Receiver Router [linked to Mambu Payment Gateway] process is automatically triggered. After the transaction is posted and monitored in ComplyAdvantage, based on the alert status, the AML status can be: Accepted or Suspended. When the payment is:

Accepted: a deposit transaction is posted in Mambu.Suspended: once all the alerts are transitioned fromIn Reviewto an end state ofAcceptedorRejected, webhooks are sent by ComplyAdvantage that automatically trigger theAlerts Analyser Router [to be linked to CA]process. If the payment is accepted, a deposit transaction is posted in Mambu, and if it is rejected, no transaction is posted in Mambu.

Direct Debit

When an incoming payment reaches the MPG, the Payment Receiver Router [linked to Mambu Payment Gateway] process is automatically triggered. After the transaction is posted and monitored in ComplyAdvantage, based on the alert status, the AML status can be: Accepted or Suspended. When the payment is:

Accepted: a withdrawal transaction is posted in Mambu.Suspended: once all the alerts are transitioned fromIn Reviewto an end state ofAcceptedorRejected, webhooks are sent by ComplyAdvantage that automatically trigger theAlerts Analyser Router [to be linked to CA]process. If the payment is accepted, a withdrawal transaction is posted in Mambu, and if it is rejected, no transaction is posted in Mambu.

Alerts logic

No Alerts

If no alerts are flagged based on the configured rules after a transaction is submitted and analyzed by ComplyAdvantage, the payment AML status is automatically changed to Accepted - since no rule was violated.

Flagged Alerts

Each defined rule generates a pass or fail response, and the failed responses create alerts. Therefore, a singular transaction can contain one or more alerts. Each alert on a transaction should be analyzed, investigated, and processed through a series of workflow states defined by you. For example, In Review, Escalated, and Accepted alert states can either be end states or not and an alert is considered to be closed when it is moved to an end state such as Accepted or Rejected.

Transactions have a priority action, which is the overall action for the transaction and is derived from the actions of all of the open alerts that a transaction has - such as Soft Stop or Hard Stop. Each time the priority action for a transaction changes in ComplyAdvantage (meaning that all alerts with the highest priority that remained unreviewed have been transitioned from In Review to an end state of Accepted or Rejected), a webhook is sent by ComplyAdvantage that automatically triggers the Alerts Analyser [to be linked to CA] process. The final webhook received for a transaction is the priority action null, which means all alerts are in an end state.

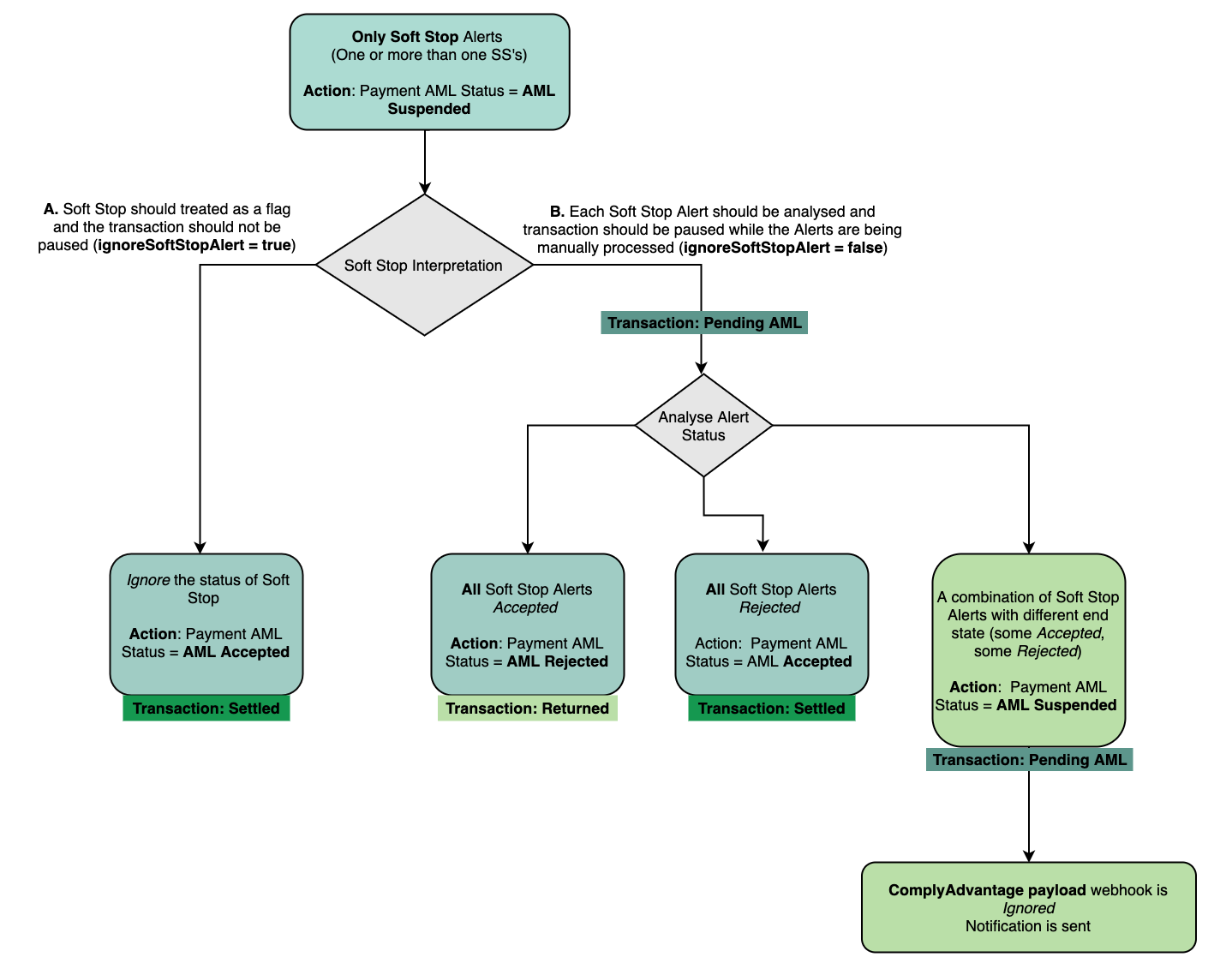

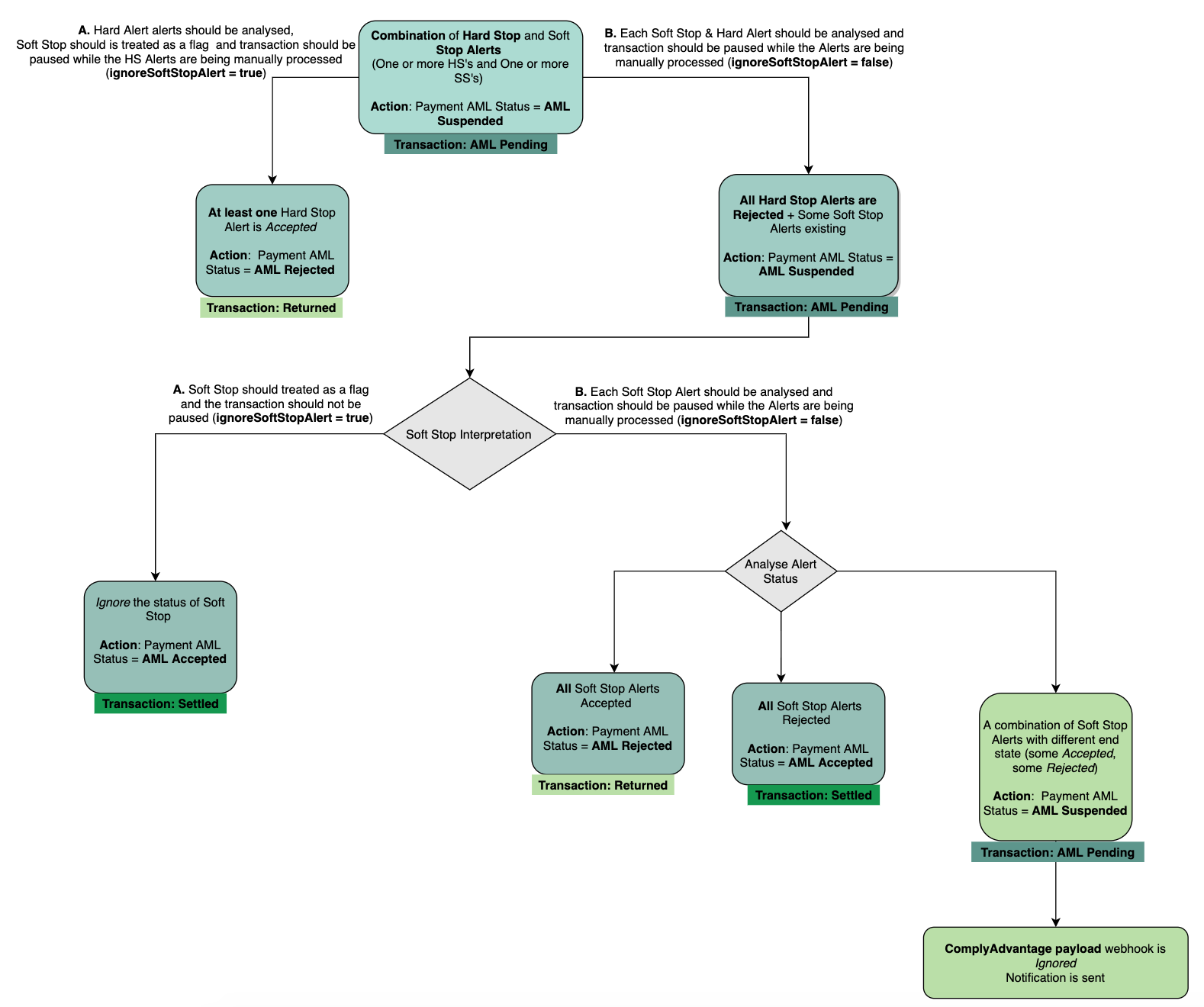

Only Soft Stop

If a transaction triggers only Soft Stop alerts, then based on the value of ignoreSoftStopAlert field (true or false) the payment can be suspended or accepted in the MPG. Once all the alerts have been transitioned from In Review to an end state of Accepted or Rejected, a webhook is sent by ComplyAdvantage that automatically triggers the Alerts Analyser [to be linked to CA] process.

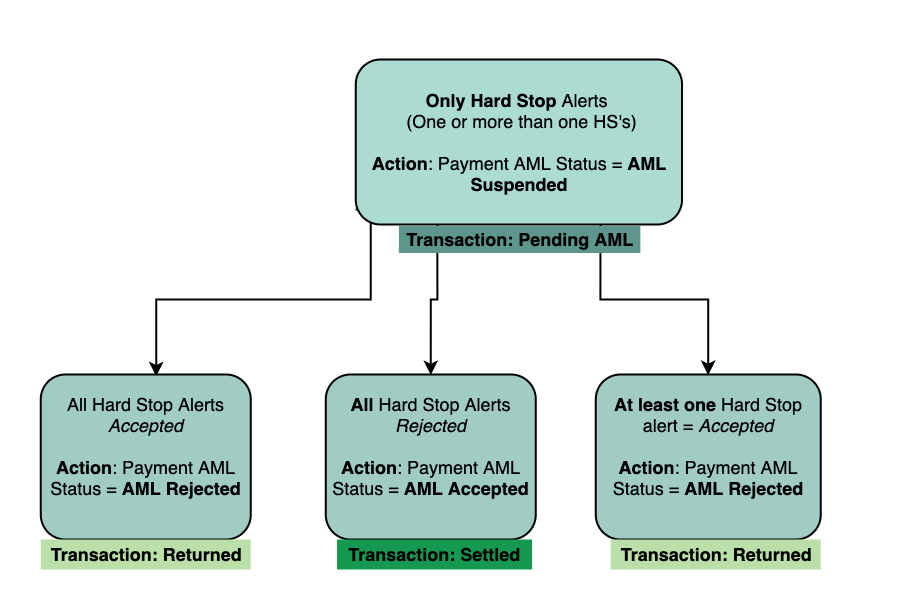

Only Hard Stop

If a transaction triggers only Hard Stop alerts then the payment is suspended in the MPG until all the alerts are reviewed. Once all the alerts have been transitioned from In Review to an end state of Accepted or Rejected, a webhook is sent by ComplyAdvantage that automatically triggers the Alerts Analyser [to be linked to CA] process.

Hard Stop and Soft Stop

If a transaction triggers Hard Stop and Soft Stop alerts then the payment is suspended in the MPG. If ignoreSoftStop = true in configuration, then the final status will be updated in the MPG after all the Hard Stop alerts are reviewed. If ignoreSoftStop = false in configuration, then the final status will be updated in the MPG only after both Hard Stop alerts and Soft Stop alerts are reviewed, with one exception: after all Hard Stop alerts are reviewed and at least one Hard Stop alert is accepted, the payment is rejected in the MPG without needing to review the remaining Soft Stop alerts.

A notification is sent when conflicting statuses, such as Accepted and Rejected, are set for the Soft Stop alerts flagged for a transaction with the following content:

Task was created due to: Conflictual Soft Stop alert states for [Incoming] Transaction message identification [A19Z8EM9F48DSE4MUZ1HRINEJ54QID] and Transaction Id [1QNEQ8LE95D63OA4HX]. Transaction was submitted in ComplyAdvantage but remain [Suspended] in Mambu Payment Gateway. Potential action: Change manually the AML status of the transaction using endpoint [POST /payments/aml] for `Credit Transfer` or [POST /collections/aml] for `Direct Debit`.

Please Note:

- Outgoing payments that are rejected are not stored in the MPG and they are not analyzed by the connector.

- In the ComplyAdvantage UI, when multiple transactions have the same alerts flagged, at least one of the transactions is reviewed and all the alerts are in an end state (

AcceptedorRejected), then the alerts end state is inherited by all the other transactions.