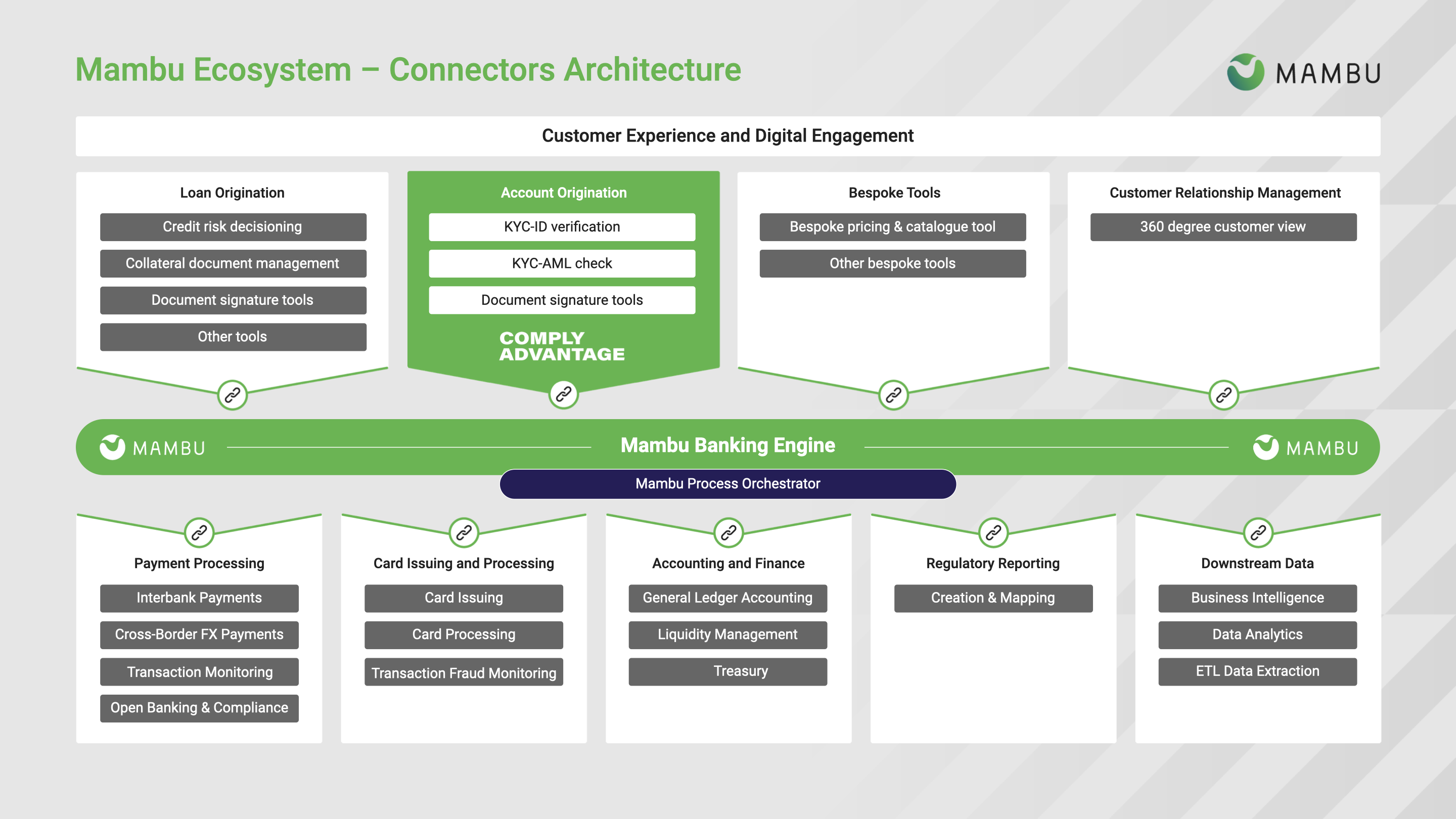

ComplyAdvantage AML for payment source Wise

ComplyAdvantage allows you to set up comprehensive rule-sets to monitor transactions in real time, screening senders, and beneficiaries against a consolidated worldwide database. You can find more details about ComplyAdvantage on the Mambu marketplace. ComplyAdvantage is present in 40 countries and has a physical presence in the United Kingdom and the USA.

Connector scope

ComplyAdvantage’s Anti-Money Laundering (AML) transaction monitoring solution manages high-risk transactions as they occur, or retrospectively via batch upload, by using a comprehensive and configurable rule-set based on suspicious activity patterns. This connector monitors outbound payments which pass through the Wise connector. The connector provides the following features:

- Outgoing payments details going through the connectors are captured and sent to the ComplyAdvantage for monitoring. The connector also allows you to choose the parameters to be sent for monitoring.

- The connector provides an extension point to fetch additional data from an external source, allowing you to monitor payments with enriched data.

- Based on the result of analysis received, the connector allows the transaction to be processed or, suspends or blocks the transaction.

- The connector also supports suspense accounting for all suspended and blocked payments.

Mambu Process Orchestrator receives the result of the AML status of a transaction, including the underlying impact of transaction monitoring from an accounting perspective.