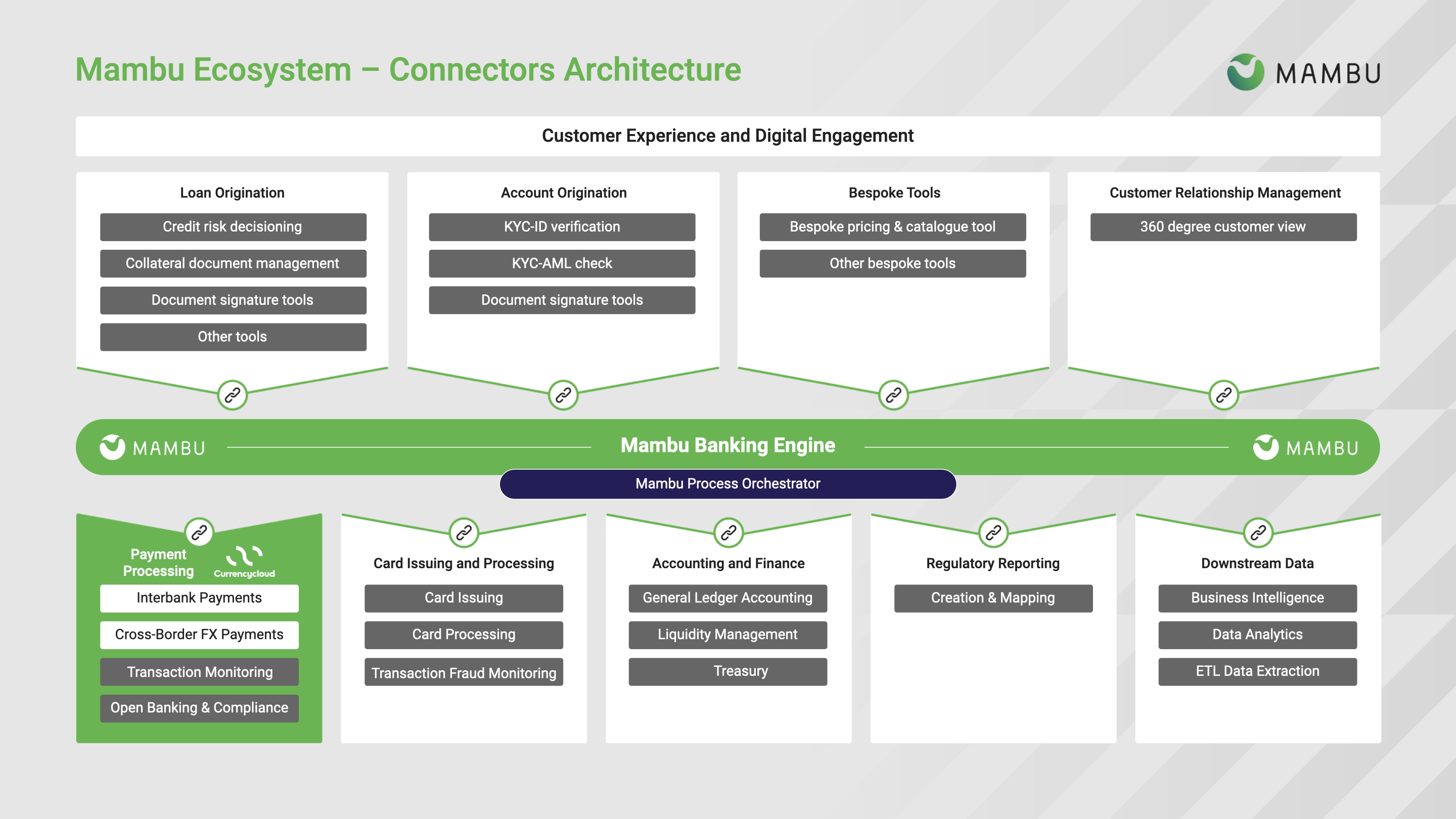

Currencycloud FX

Currencycloud offers a global payments platform built on smart technology that takes the complexity out of moving money. Currencycloud’s payment processing engine with liquidity and multi-currency payments solves key problems, including:

- A global collections solution to provide your customers customized payment solutions wherever they are.

- Automated FX risk management, with real time wholesale FX execution.

- Straight through payment processing including built-in validation and compliance processes.

- Low fees for SWIFT and local payment networks that guarantee your customers receive value for money.

- Automated payment runs with bulk file uploads.

For startups building their own banking services, building a global payment solution can prove expensive and time consuming. Like Mambu, Currencycloud is API-driven, which allows you to integrate its out-of-the-box solutions into your own platform without having to build everything from scratch. Currencycloud’s platform is fully composable, allowing you to take advantage the agility, speed, and efficiency of cloud-based technology. Currencycloud has a global footprint but strong support for SEPA makes this connector ideal for financial institutions dealing with Euro-based accounts and clients.

You can even use the white label Currencycloud Direct Platform and get started straight away with a branded platform. You can find more information about Currencycloud’s solutions on their website or head to the developer portal where you can also test their APIs in a demo environment.

About the connector

Early Access Connector

If you would like to request early access to this connector, please get in touch with your Mambu Customer Success Manager to discuss your requirements. Find out more about the connector readiness status.

The Currencycloud-Mambu connector acts as a middle layer to monitor payments being made to and from your Currencycloud accounts and automatically create the necessary transactions in your Mambu core banking system.

The connector supports the full end-to-end flow: from automatically creating and linking contacts and sub-accounts in Currencycloud when a new client or deposit account is created in Mambu, to processing incoming and outgoing payments with optional anti-money laundering checks.