Business Flows

This template allows you to use the direct debit facility for loan repayments and savings account top-ups.

GoCardless connector handles the following main flows:

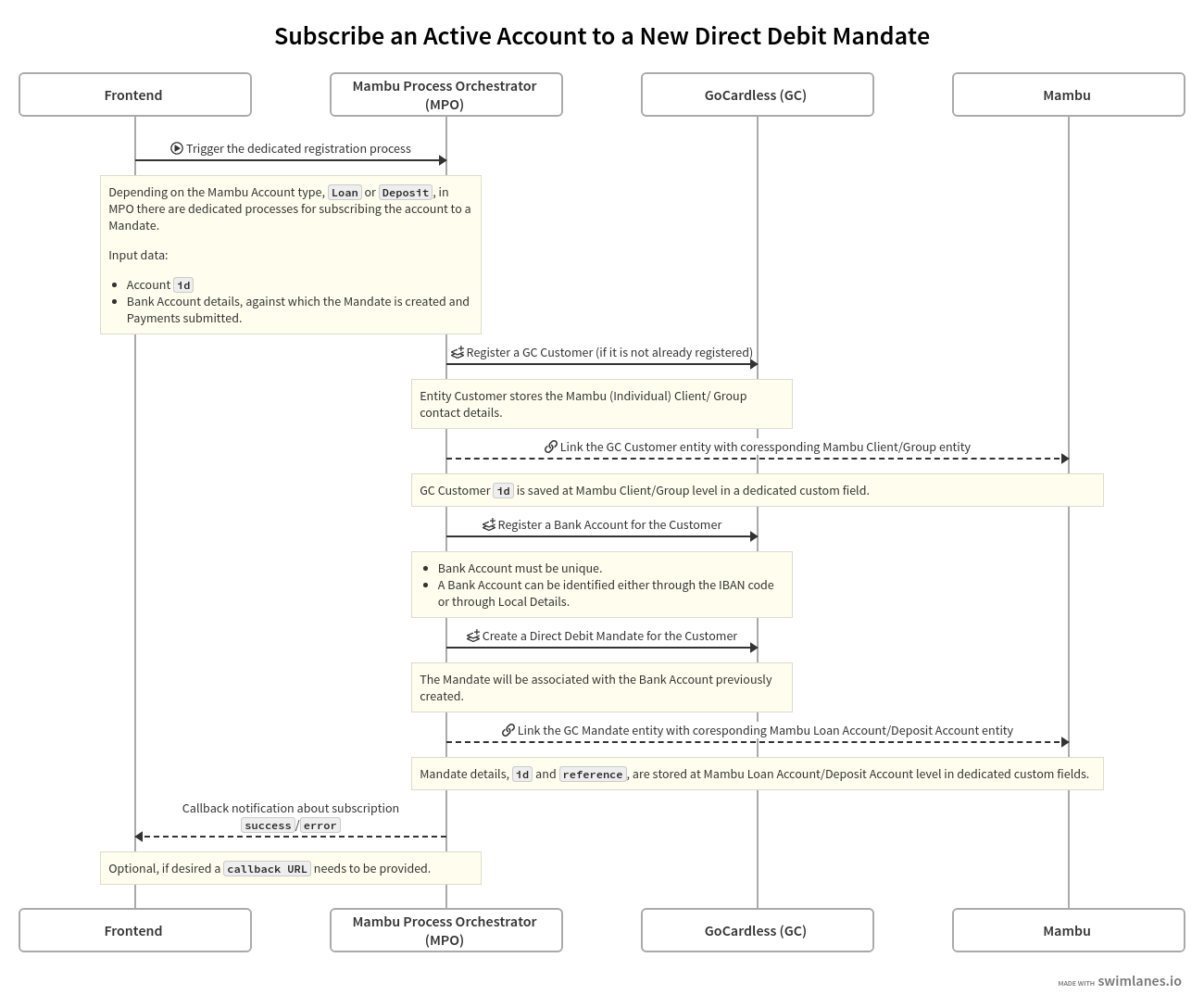

- Subscribe a loan or deposit account to a new direct debit mandate.

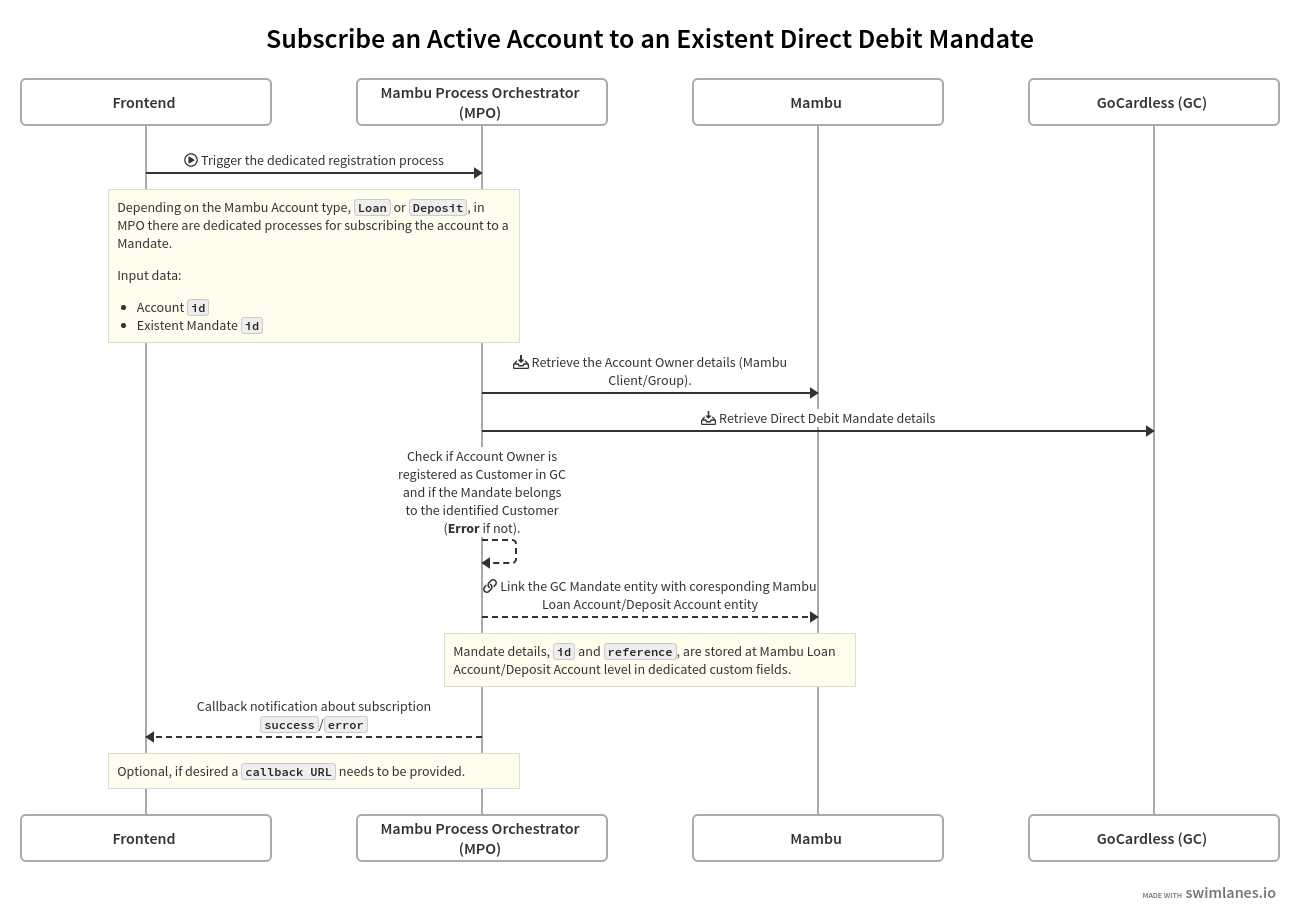

- Subscribe a loan or deposit account to existing direct debit Mandate.

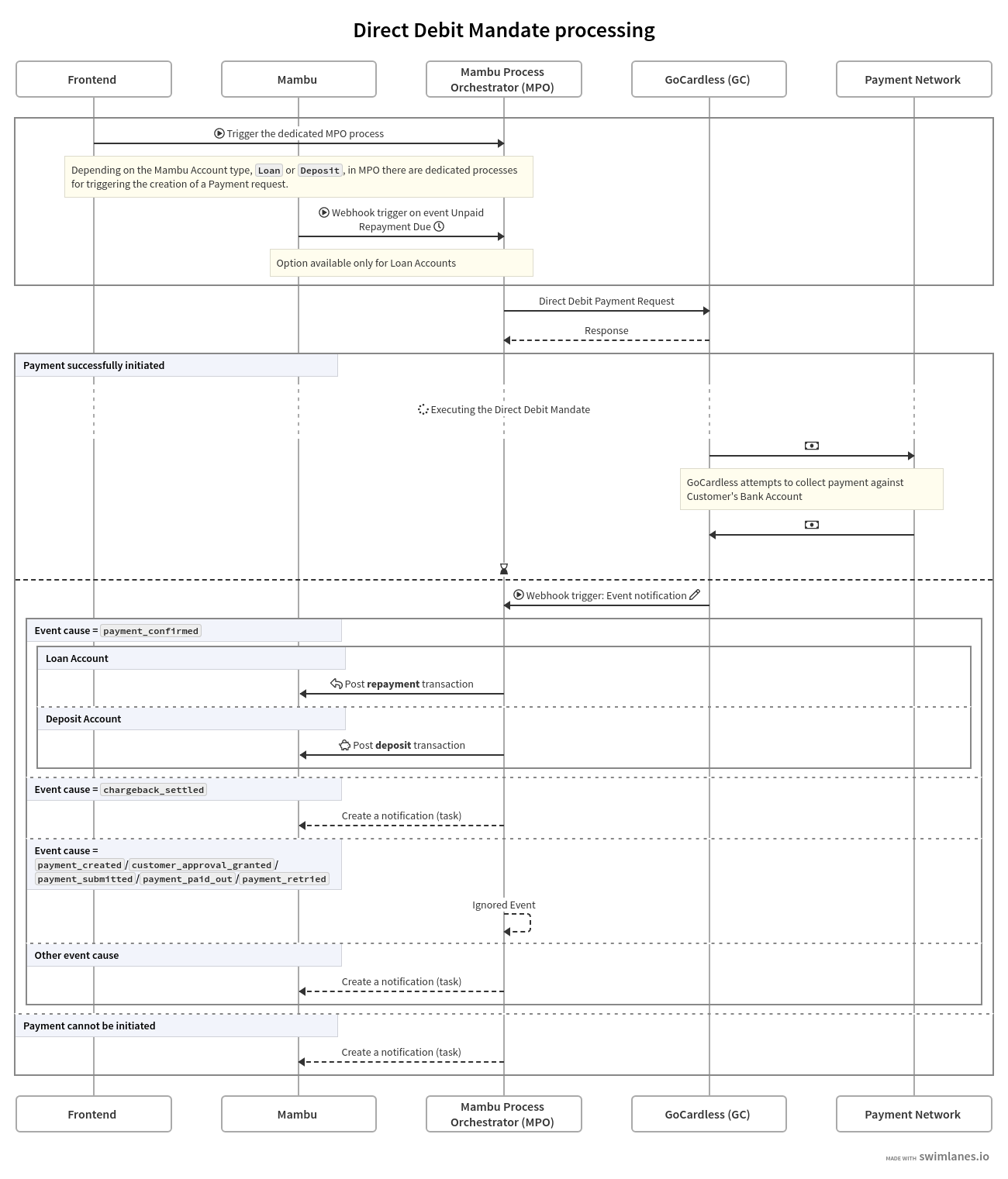

- Create loan or deposit direct debit payment request.

- Handles the mandate and payment events received from GoCardless.

Additional details

The Entity Customer stores the Mambu client contact details. The Customer id is saved at Mambu client level in a dedicated custom field. Each customer can have several customer bank accounts with which multiple Direct Debit mandates can be associated.

The bank account must be unique or a bank_account_exists error will be returned.

A mandate is an authorization from a client to collect future payments and it is identified through a mandate id and reference. Mandate details - such as id and reference - are stored in Mambu at the loan or deposit account level custom fields. On the first payment request the charge date needs to be set after the mandate becomes active. If the charge_date value is before the mandate’s next_possible_charge_date, payment creation will fail.

To avoid the loan account going into arrears or having penalties applied if GoCardless collects the amount after the charge_date, the repayment transaction is posted having as value for the bookingDate with the charge_date value.

The deposit transaction is booked on the same date as when the confirmed status for the payment is received from GoCardless