Reserve Loan Account

Creating a new business or individual relationship in nCino creates a matching record in Mambu, keeping your core banking solution in sync with your customer relationship management software.

Reserving a loan account

The process for reserving a loan account works as follows:

- Create a new relationship in nCino of the type

BusinessorIndividual.

Please Note:

When creating a new Business relationship type in nCino, you can also select the business structure: corporation, partnership, cooperative, and so on. In order to align both systems, the same selections should be defined in Mambu as well.

- For Business relationships, contacts can be added if desired. If a primary contact exists, their details are used to create a new client record in Mambu as a group member. If no primary contact has been selected for the relationship, a random contact is used to create the group member in Mambu.

- Create a loan account with the necessary information for each loan type.

| nCino Trigger | Relationship type | Result | Synced fields |

|---|---|---|---|

| Reserve loan offer action | Business | Group created in Mambu. | - Group Name - Group ID = recordId from nCino- Group Member - Group Type (Default or nCino business type, if it exists in Mambu) - Group Custom Fields (if they were defined in the Customisation SD state diagram) |

Business | Contact created in Mambu | - First Name - Last Name - Mobile Phone | |

Individual | Client created in Mambu | - Client First Name - Client Last Name - Client ID = recordId from nCino- Client Custom Fields (if they were defined in the Customisation SD state diagram) | |

Business or Individual | Dynamic or Fixed loan account created in Mambu. | - Loan Name - Loan Amount (nCino Original Amount) - Anticipated Disbursement Date (Projected Closed date) - First Repayment Date (First Payment Date) - Repayment Frequency (deducted from nCino First Payment Date, Payment Schedule, and Loan Term Months parameters)- Interest Rate (only if the product has a Fixed Interest Rate) - Interest Spread (only if the product has an Index Interest Rate) - Periodic Payment (only if the product has Balloon Payments) - Grace Period (only if configured on the loan product) - Disbursement fees - Branch | |

Business or Individual | Revolving credit account created in Mambu. | - Loan Amount (nCino Original Amount) - Interest Rate - Flat Amount Repayment or Percentage of Total Due to Pay or Percentage of Principal to Pay - Based on the product principalPaymentSettings- Branch | |

Business or Individual | Tranched loan account created in Mambu. | - Loan Name - Loan Amount (nCino Original Amount) - Anticipated Disbursement Date (projected closed date) - First Repayment Date (first payment date) - Repayment Frequency (deducted from nCino First Payment Date, Payment Schedule, and Loan Term Months parameters)- Interest Rate (only if the product has a Fixed Interest Rate) - Interest Spread (only if the product has an Index Interest Rate) - Grace Period (only if configured on the loan product) - Tranches (one tranche with the entire loan amount) - Branch |

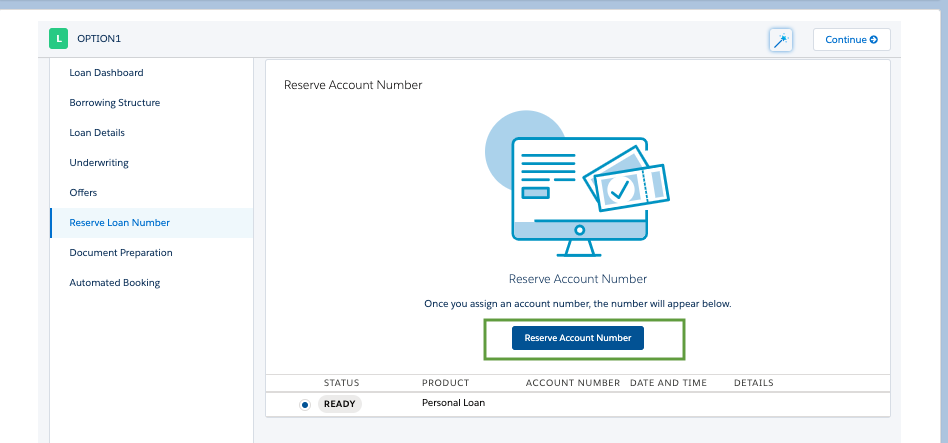

- Reserve the loan account in nCino by clicking Reserve Account Number.

- The Mambu loan account custom fields will be updated when they are reserved, if they were created in Mambu and defined in the setup process.

Configuring the loan account

Once the loan account has been reserved, the client is created in Mambu in the state configured in Administration > Internal Controls, which may be either Inactive or Pending Approval. If the client is created in Pending Approval state:

- It is automatically set to

Inactiveby the Mambu Process Orchestrator (MPO) process, so that loan account creation is possible. - The loan account is created in the

Pending Approvalstate.

Furthermore, these actions trigger the following updates:

- If the

branchat client or group level is changed in Mambu, all loan accounts are updated with the new value. If the branch is changed from within nCino at the relationship level, no updates are made to the account in Mambu. - The

Email addressat relationship level in nCino is sent whenReserveandBookactions are executed. - Before the

Reserveaction, a loan account can have multiple relationships in the borrowing structure, for example multiple guarantors and a single borrower. A borrower Relationship gets updated in nCino with thelookupKey. In Mambu, the loan account is created under the borrower relationship type.

If anything changes in the borrowing structure between the Reserve and Book actions, this change is not updated in Mambu.

Repayment frequency

Repayment frequency is defined in Mambu through the following parameters: numberOfInstallments, repaymentPeriodCount, and repaymentPeriodUnit. For the repayment frequency to be calculated, the following fields are mandatory in nCino: First Payment Date, Loan Term (Months), and Payment Schedule. For computing the number of grace installments, the following fields are mandatory in nCino: First Payment Date, Interest Only Months, and Payment Schedule.

Tranched loans

In case of a tranched loan, the loan account is created with a single tranche containing the entire loan amount. The anticipated disbursement date takes the value of the Projected Close Date from nCino.

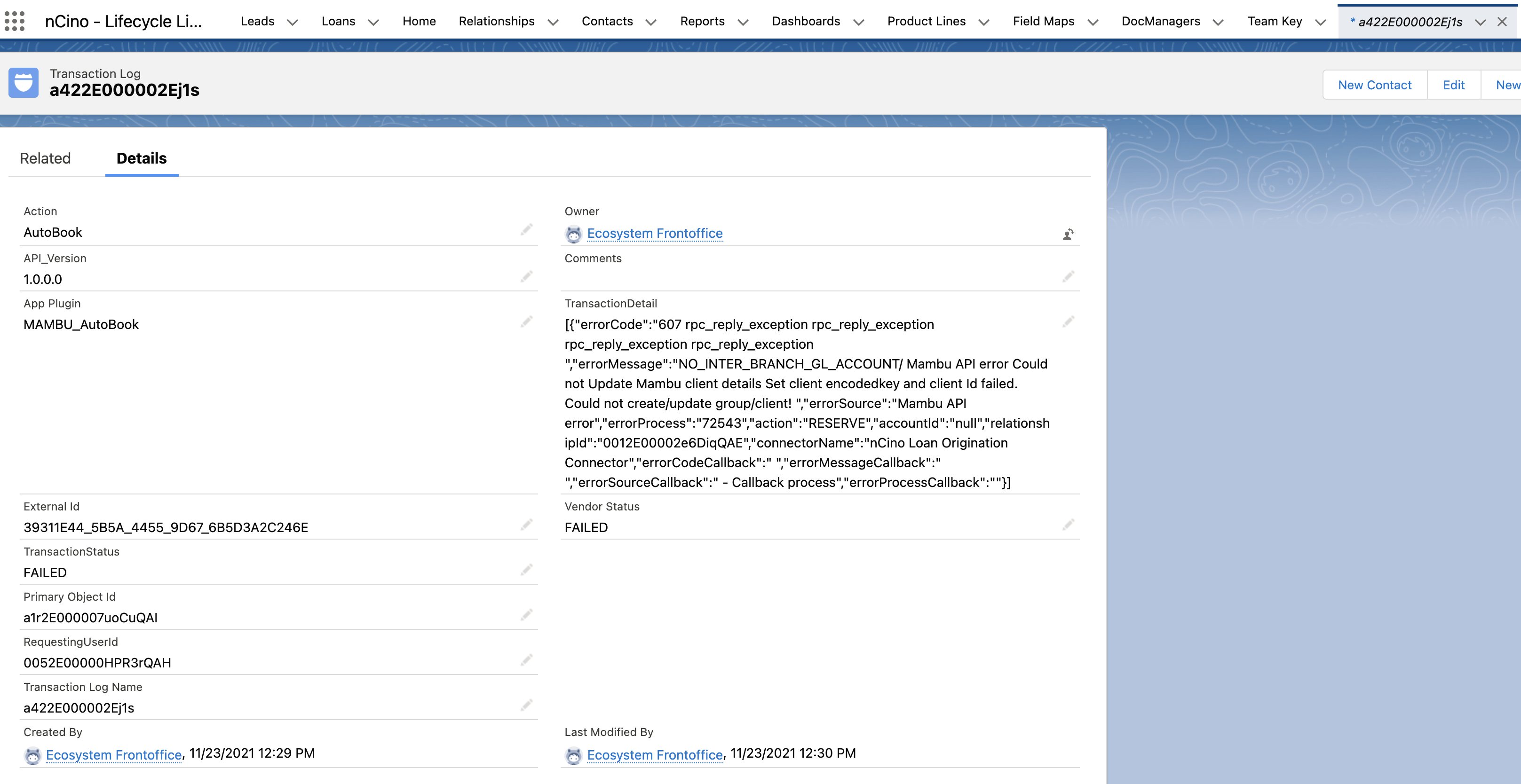

If the reserve loan account fails

When triggering the reserve flow from nCino, a transaction log is created. This log holds the transaction status of the flow, along with other details. In case of an error during the reserve process, the transaction log is updated with details of the errors sent from MPO. Vendor Status and Transaction Status are set to FAILED.

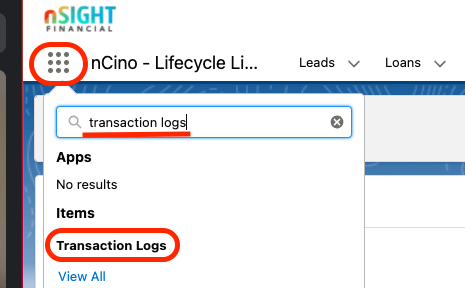

To view transaction logs after an error occurred in the reserve flow you need to:

Click the highlighted menu on the top left and search for

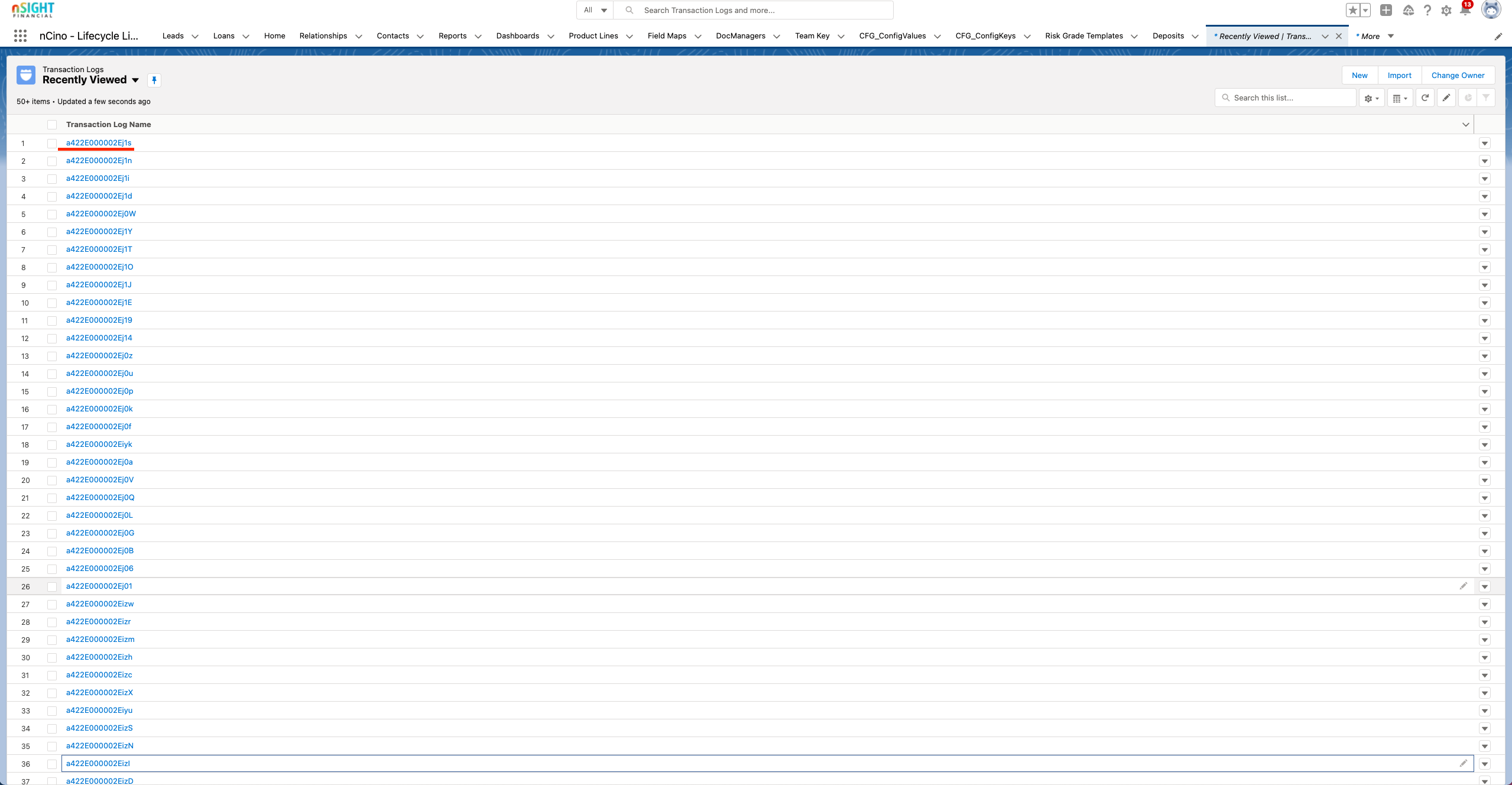

Transaction logs.

The most recent logs are at the top. You can also search by transaction log ID, transaction log name, or by external ID to narrow down the results.

Open the log you want to view. For example, this is how a transaction log created after an error looks like.